The bank’s positive forecast addresses concerns about rates, inflation, growth and unknowns ahead.

UMB, the regional commercial bank, presented a surprisingly upbeat economic forecast for this year to assistant treasurers in a recent meeting, suggesting less likelihood they will face difficult choices to help guide their companies through a recession or skyrocketing inflation.

- “On our side,” said an assistant treasurer attending the meeting of NeuGroup for Large-Cap Assistant Treasurers, “it’s fear of the unknown,” given the Fed failed to foresee the inflation spikes “and no one seems to understand what’s going on.”

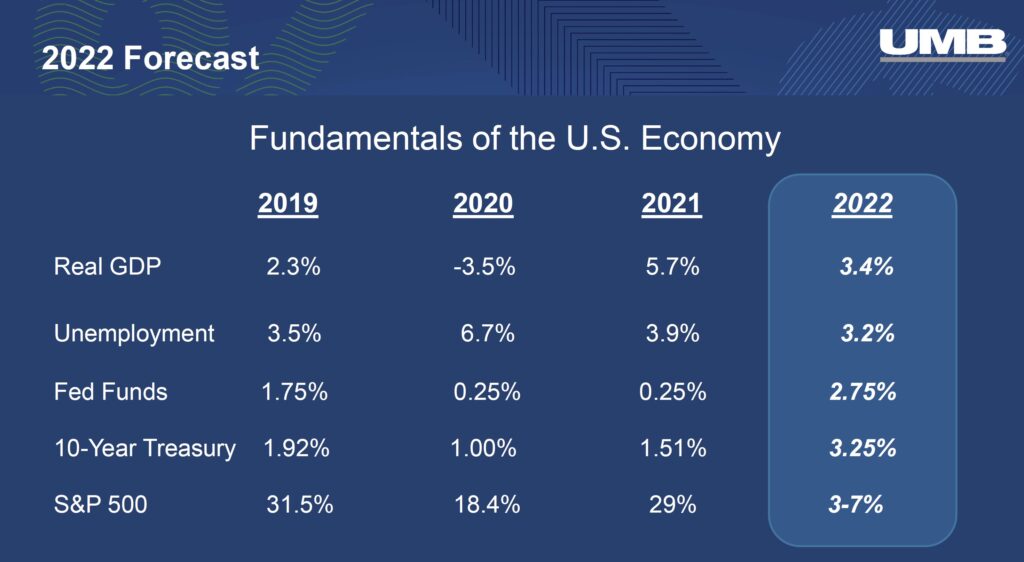

- Addressing those unknowns, the bank’s director of research and fixed income, Eric Kelley, told the group that UMB forecasts GDP growing by 3.4% in 2022 (see chart), lower than last year but still high historically, and inflation will drop significantly over the next few months based on technical reasons alone.

Rate hike fears overblown. The Federal Reserve’s “dot plot,” illustrating board members’ votes on a time chart, indicates the central bank will raise the Fed Funds rate to 2.75% and perhaps 3% this year, and another quarter-point or two in 2023, then pause.

- “Not enough to derail the economy; not even close,” Mr. Kelley said, and “The Fed believes that’s their new neutral rate, and it will be good enough to slow down economy.”

- The market sees a slightly higher increase this year, at 3.25%, still historically low, Mr. Kelley said, adding that recent volatility in the bond and stock markets has stemmed more from the unexpectedly rapid nature of the rate hikes than longer-term concerns.

Deceptive headlines. US GDP decreased by an annualized negative 1.4% in Q1, but behind the headlines and excluding exports and inventory builds—both volatile components—the economy actually grew at 2.8%, Mr. Kelley said.

- “I was surprised how that print did not cause much market turmoil,” noted a meeting participant, adding that Fed Chairman Jerome Powell effectively conveyed that context in his press conference.

Factors powering growth. A housing glut and bust prompted the Great Recession, but today’s housing market and the economic activity it generates show no sign of weakening, despite mortgage rates jumping more than 200 basis points this year, to around 5.25%.

- A member asked where UMB sees mortgage rates topping out, and Mr. Kelley noted they tend to follow the 10-year Treasury which the bank forecasts increasing to 3.5% or possibly 3.75%.

- “That should put mortgage rates in the high 5s, maybe 6%,” Mr. Kelley said, adding that could impact first-time homebuyers but not overall housing demand, given historically low housing inventory that is unlikely to meet demand anytime soon.

- Another factor powering growth is resilient households, bolstered by today’s strong job market and the accompanying higher wages.

- “We’re in a bit of a housing bubble in San Francisco,” commented a meeting participant, “But people are still buying up houses and spending.”

- Assuming no more major surprises this year, UMB expects the S&P to end the year net positive, up 3% to 7%.

Inflation falling. Dramatic inflation numbers have prompted the Fed’s rapid rate increases this year and much of the volatility in the securities markets, but those numbers won’t last.

- On the technical front, year over year price comparisons between the first months of 2022 and 2021, when much of the economy was in lockdown, resulted in annualized inflation reaching 8.5%. But prices began rising significantly last summer as the economy opened, reducing that month-to-month spread.

- “By year end, inflation should drop by at least 100 basis points, maybe 200, just because of the math,” Mr. Kelley said.

- In addition, factors that have fueled inflation, including supply chain challenges and wage increases, are moderating, he said, adding that the Fed closely monitors the US 5-year/5-forward TIPS breakeven inflation rate, and it shows inflation resting in the agency’s comfort zone of 2.3% to 2.5%.