BondCliQ’s solution can give companies more insight into which dealers are supporting secondary trading.

A lack of liquidity in the secondary market for investment-grade corporate bonds remains a source of frustration for many corporates that have issued record amounts of debt in the wake of the financial crisis and, more recently, during the pandemic.

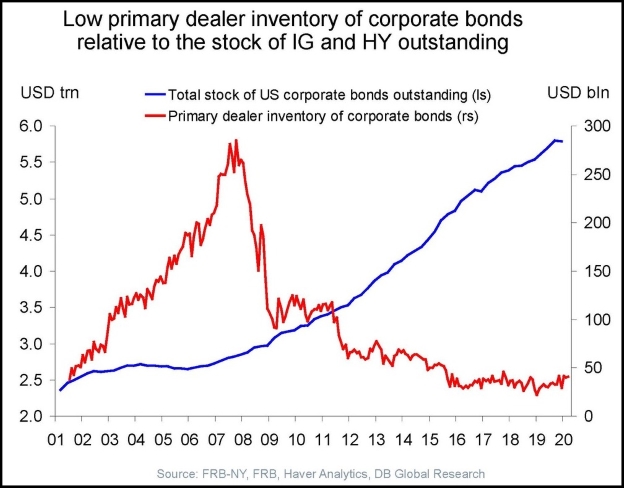

- A key reason for the liquidity problem is that broker dealers, including underwriters, have reduced their inventories of investment-grade corporate debt, in part because of regulations mandating higher bank capital ratios.

- And despite improved transparency on corporate bond pricing and institutional investor portfolio holdings, information about which banks are making secondary markets for debt issues remains opaque.

Enter BondCliQ. This fall, NeuGroup members had the opportunity to hear about one company’s technology solution that’s designed to provide more transparency and liquidity to this market by providing real-time data from over 35 dealers giving more than 40,000 price quotes daily.

- BondCliQ founder and CEO Chris White described to members how his company’s analytics can help corporates reduce future funding costs.

- The company says that by using performance metrics, treasury teams can review statistics on how corporate bond market makers support a company’s debt in the secondary market and improve their selection of underwriters, driving the best possible outcome on a new issue.

- BondCliQ’s value proposition rests on the idea that if more investors perceive a company’s bonds to be fungible and liquid, demand for the bonds rises and the cost of debt capital falls.

Data combo. BondCliQ says that if leveraged properly, the information in its issuer performance reports can help lower an issuer’s cost of capital. The report combines traditional and proprietary data sets in the following categories:

- Pre-trade data. Bids and offers are directly derived from the company’s community of bond dealers, letting users know the market value of their debt.

- Post-trade data. Transaction information is sourced directly from FINRA’s Trade Reporting and Compliance Engine (TRACE), allowing issuers to monitor trading in their bonds.

- BondCliQ performance data. Comparative analytics for illustrating the performance of corporate bond dealers lets issuers evaluate potential underwriters.

Technology in the toolbox. “There are several factors which go into the selection of underwriters,” Mr. White said. “We view our product as a technology-driven solution that treasurers can add to their toolbox to make the best decisions possible for their companies.”