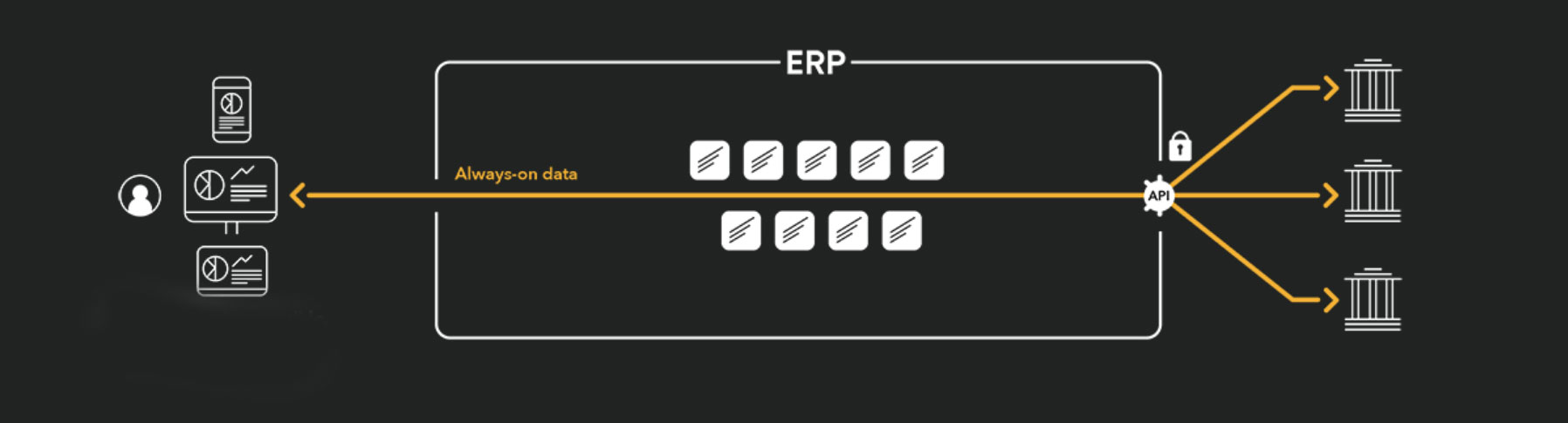

Consider the value of connecting your treasury and financial operations teams via the ERP they all access to banks in real-time.

Having conducted three focus groups of NeuGroup members over the last 6 weeks—targeting senior treasury managers, treasury and financial technology support specialists and AR/AP/Cash applications and general financial operations managers respectively—we can now share the key member-validated findings regarding FinLync and solutions like it. While the focus groups were comprised of members from companies with SAP as their principal ERP, many apply to companies with other ERPs. Plus, while FinLync is certified for SAP (from ECC 6.0 to S/4 HANA), it plans to release native apps for Oracle and MS Dynamics soon.

- One of the takeaways that cannot be ignored is that SAP, despite decades of working on it, has not managed to create its own solution to deliver on the promise of marrying transaction data from banks with that within the ERP, in a straight-through manner, without loss of data detail and in a timely way.

There are myriad reasons for this. The one that most resonates is that SAP itself tends to introduce functionality that works with the latest version, which very few SAP companies have implemented across all functions and instances, and even fewer see finance functions at the early phases of their upgrade timelines. Finance and treasury practitioners are thus used to waiting and usually end up implementing another solution that connects with banks while delivering needed functionality and that pulls data out of SAP instead.

- FinLync’s key value proposition is that it has developed API links to banks, which is where connectivity to banking and financial services is moving, with direct access to ERP data tables across instances and versions of the ERP. With SAP, FinLync works with ECC 6.0 to the latest S/4HANA and delivers the modern Fiori user experience regardless.

- For banks that are not API-ready, it also has a connectivity aggregator to connect via SWIFT, host-to-host or via a gateway bank or other provider.

- There is the potential that banks in developing markets may choose to leapfrog to APIs’ connectivity, even before joining SWIFT.

While not all members are fully sold on the value of real-time treasury for everything, there is wide recognition that the quality, detail and security of data exchanged via API connections is a huge value add. For example:

- API connections give real-time visibility not only to when the payment arrives at the beneficiary’s bank but the number of “hops” the payment made to get there and what fees were charged along the way.

- API connections along with native integration with the ERP mean that machine learning and AI algorithms get better, faster at learning your patterns and analyzing all the data in the ERP to auto-reconcile and forecast cash flows. The typical 60% out-of-the-box accuracy can be higher and the path to 95% or better accuracy can be much shorter.

- API connections are encrypted two-way communications between your ERP’s data tables and those of the bank’s system, so there is no writing to a data file that can be altered as it makes its way from your systems to the bank’s. This is an inherently more secure way to connect financial systems.

Further, treasury and financial operations cutting across commercial and treasury payments come together in new centers of excellence or global solutions centers. Thus, it is increasingly important to provide common applications that process all incoming and outgoing payments, along with all the data relevant to them, to drive better reconciliation, forecasting and, most importantly, insight about your business.

- Embedding connectivity and applications in the ERP opens access to bank data beyond users with access to treasury systems and electronic banking portals—plus with better timeliness and data quality. No longer do you have to get licenses and implement the TMS at shared-service centers, for example.

- Leveraging user familiarity, systems support and controls that come with ERP applications also empowers financial operations scalability and flexibility. Finance can rethink processes and who does what work end-to-end, plus shift more resources as automation, smart bots and AI take on more transaction processing and reconciliation activity.

And finally, as an application that installs easily into SAP, and soon other ERPs, and that helps transcend versions and instances with the delivery of desired functionality, many treasurers and their finance colleagues may be able to:

- Fully justify the cost alongside a traditional TMS or other treasury systems that deliver functionality that FinLync does not, as well as duplicative functionality that FinLync delivers much better.

To learn more about FinLync, join us on Friday, May 21 from 12:00 to 1:30 pm ET as we discuss the above and other findings and give those who have not seen FinLync before a quick demo.