With companies facing strong economic headwinds, treasurers are doubling down on liquidity management.

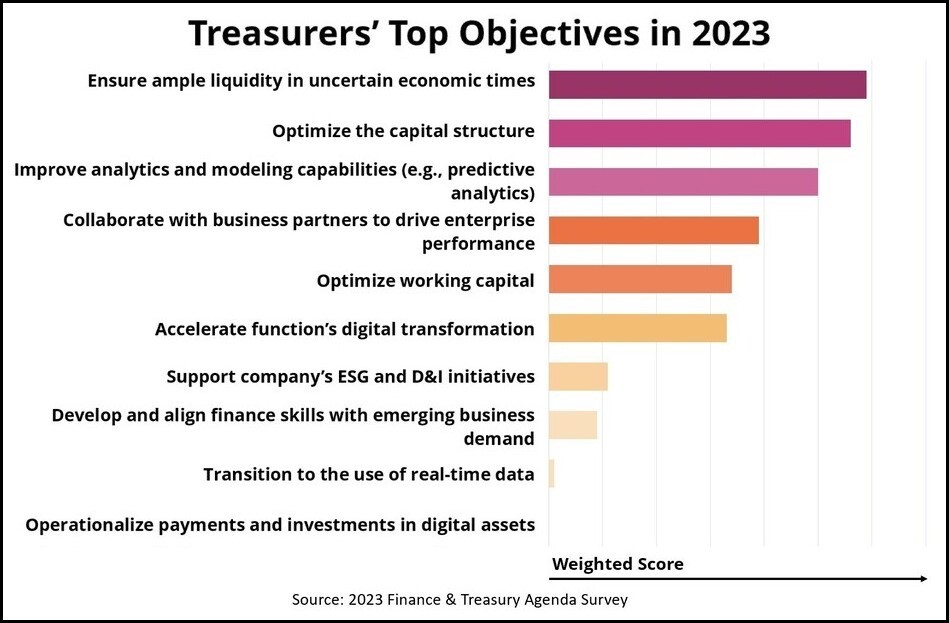

Treasury’s core mandate is to support the company’s performance by ensuring adequate funding through smart cash management and external borrowing. According to NeuGroup’s 2023 Finance & Treasury Agenda Survey, treasurers plan to make that their number one priority this year (see chart).

The survey also showed that treasurers are targeting improvements in analytics and modeling capabilities, which came in at number three this year, up from seven in 2022. After years of ample cash, liquidity is at a premium; however, our 2022 Cash Forecasting Survey revealed that the majority of treasuries struggle to produce a reliable cash forecast. The latter is a prerequisite to making smart funding and investment decisions.

By adopting advanced analytics solutions with built-in machine learning and AI tools, treasuries can achieve greater accuracy while reducing overall workload. According to our data, full implementation of advanced analytics solutions will more than triple from 17% currently to 57% in the next 12-24 months.

Recognizing the tradeoffs

The focus on liquidity plays directly into treasury’s core strength and will raise the function’s stature within the organization; however, the return to basics has also triggered a “downgrading” in the importance of other objectives. For example, collaborating with business partners dropped to number four this year, down from the top spot in 2022. Digital transformation (#3 in 2022) fell to the sixth slot, and talent development ended up eighth, down from the fifth spot last year.

This reprioritization reflects the harsh reality of a challenging economic environment, in which initiatives without a clear or immediately positive ROI are often starved for resources. Treasurers must be cognizant that in making these tough choices, they accept some potentially dangerous tradeoffs, i.e., they run the risk of losing momentum or even ground on important initiatives.

Perhaps the most worrisome shift in the rankings involves the fall of digital transformation to sixth place. The growing pressure on profit margins, from higher cost and lower revenues, translates into a need for significant cost reduction, hence greater automation. While some projects exhibit a quick payoff (e.g., some RPA projects), others take longer to show a positive ROI. Regardless, failing to progress or even decelerating digitization efforts will end up costing more in the long run.

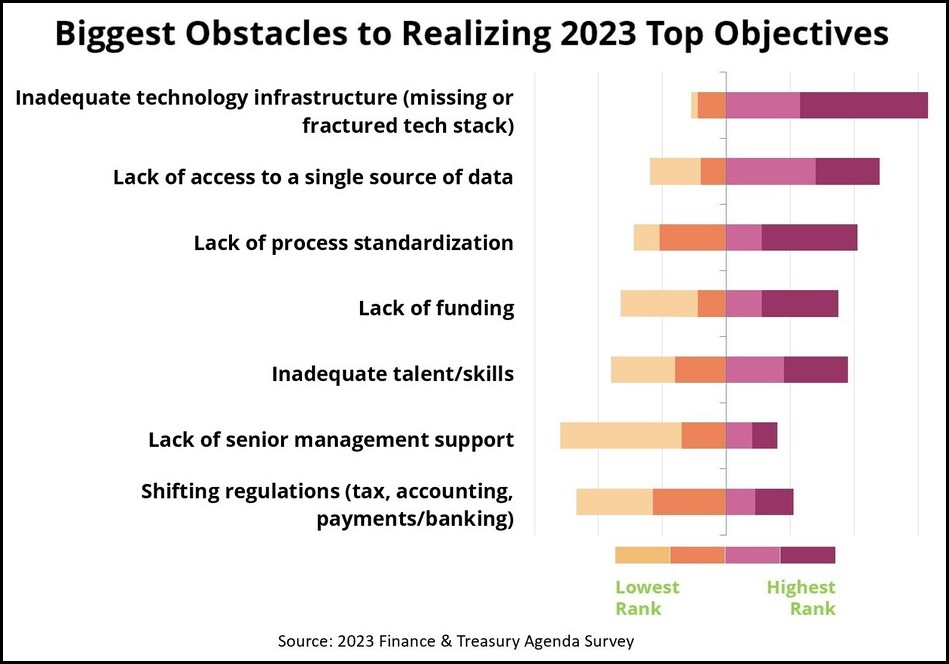

Plus, the low priority given to digital transformation is perplexing because, as the chart below shows, survey respondents ranked inadequate technology (a missing or fractured tech stack) and lack of access to a single source of data as the number one and two obstacles to realizing their overall 2023 goals.

The challenge for treasurers is to continue to move forward on automation, even when budgets are tight. Making a strong case for a TMS has been a perennial challenge and may become more so in this economic climate. But treasury has other options. They can piggyback on larger finance transformation initiatives by convincing the CFO that there are good use cases in treasury for other technologies, e.g., RPA or even analytics tools embedded in FP&A planning systems. We already see the early signs of migration to robotics solutions. According to our survey, while full-scale implementation of RPA will remain at the current level of 33% into ’23-’24, the percentage of treasurers that plan to pilot robots is expected to jump by nearly five times from today’s 5% to 24% in the next two years.