One portfolio manager’s investment in ultra-short securities helps shed light on an underrated way to pick up yield.

Investment managers prospecting for opportunities to pick up yield as rates rise may find gold in the hills of short duration credit. At a recent meeting of NeuGroup for Cash Investment sponsored by investment management company Lord Abbett, the portfolio manager of a private university with a large endowment shared how he capitalized on rising yields for short-term investments by working with Lord Abbett at the start of the pandemic—and went back for more.

- “You want to understand the volatility, and make sure the institution can tolerate that,” the portfolio manager said. “But looking forward, there is a yield pickup there,” he said of his investment in credit and other ultra-short duration assets.

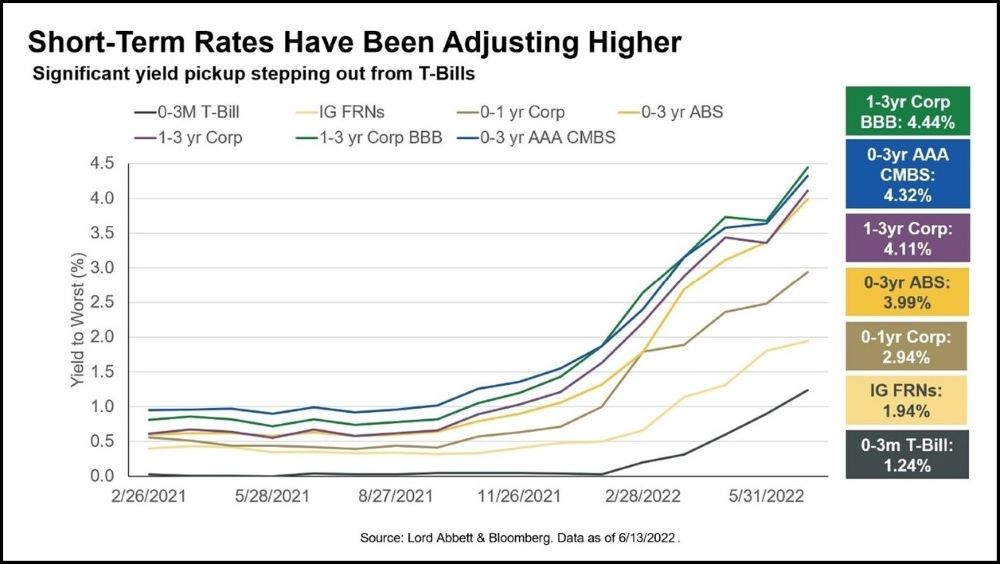

- Lord Abbett investment strategist Joseph Graham, who worked with the university on this investment, said, “Now, yields are up and spreads are wider, and as inflation ravages the purchasing power of cash portfolios, the case for short duration credit is even more compelling,” adding that the firm’s clients “are continuing to find value in our broad-based approach.”

The client’s journey. The portfolio manager said the university had good deal of cash on its balance sheet in early 2020, when pandemic era policy rates combined with tight spreads meant traditional cash management options offered nearly no yield, leading him to be “more proactive with the management of this cash,” which was sitting in money market funds (MMFs) at the time.

- After speaking with Mr. Graham and Samantha Scher, who leads Lord Abbett’s institutional sales team, the manager made an initial investment topping $100 million through a separately managed account with Lord Abbett that included credit and other short duration assets like treasuries, picking up 60 basis points of additional yield compared to the MMFs.

- Later in 2020, the university created a second, more conservative customized allocation of a similar size with Lord Abbett, picking up 20 basis points of yield over money market options.

- Because of the university’s liquidity needs and the uncertainty of the pandemic, the manager was limited to a shorter term. “As we evaluated different strategies, we had good visibility for 12 months, but not beyond that,” he said. “So we had to focus on ultra-short.”

- “The yield and spread environment [in 2020] was a driver of a more broad-based approach that included credit-sensitive assets for this cash management client,” Mr. Graham said. As yields rise at the short end of the market and spread volatility returns, an active, short duration, credit-focused strategy can compete with core and intermediate fixed income options.

The case for short-term investments. Though Mr. Graham conceded that turning to short-term investments for yield pickup is somewhat counterintuitive, he said “that is indeed the case if you look at the data.”

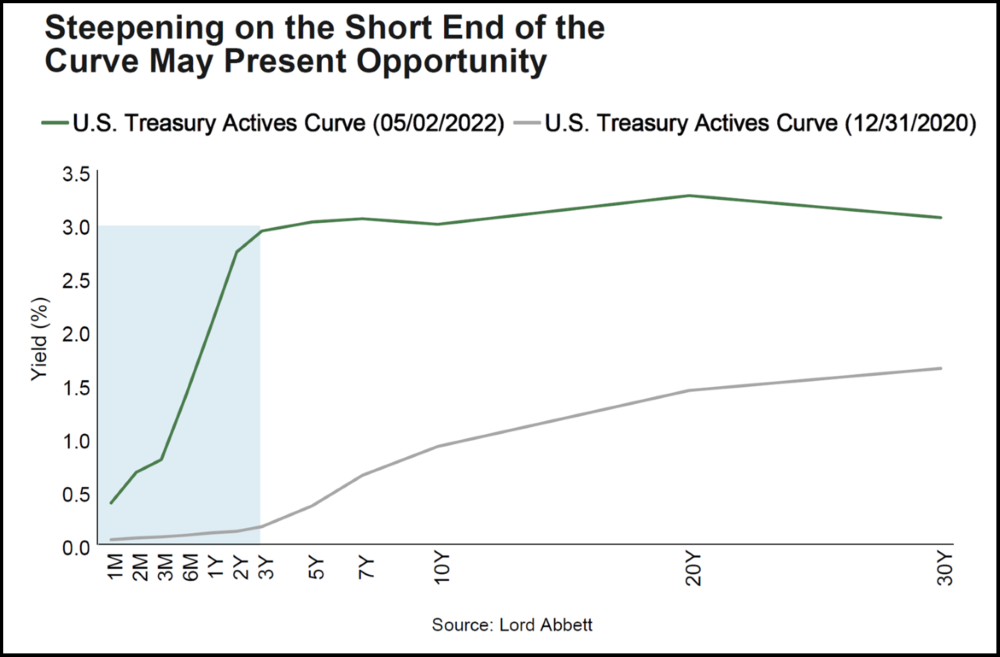

- Lord Abbett presented the chart above comparing the performance of actively-traded US Treasuries from 2020 and now. Because the yield curve is steep through the first three years, then flattens out, short-term (one to three-year) securities make sense right now, particularly in light of uncertainty around the persistence of inflation, noted Mr. Graham.

- “You can kind of think of this as an efficient frontier, with term as the biggest risk in fixed income and yield as the biggest component of return,” he said. “It’s tough to justify being anywhere but the one- to three-year area, as long as you have visibility into your liabilities and you’re matched appropriately.”

The case for credit. To help explain the viability of short-term credit investing, Mr. Graham compared it to the concept of matching liabilities and assets in liability-driven investing, instead using credit to offset liabilities. “The question becomes, how much can you really use credit to do this?,” he said. “Aren’t you exposing yourself to principal losses in addition to price volatility?”

- The answer, he said, is that historically there aren’t many principal losses in short and high-quality credit investments. “The price volatility and liquidity risk is what you’re solving for,” he said. “By matching assets to liabilities, you can afford some of that price volatility and basically are monetizing the liquidity risk by having the ability to hold through it.

- “In times of volatility, because it’s short-duration and matures relatively soon, as long as a manager is doing good work underwriting credits and there are limited principal losses you do get that pullback to par as things start to reach maturity.”

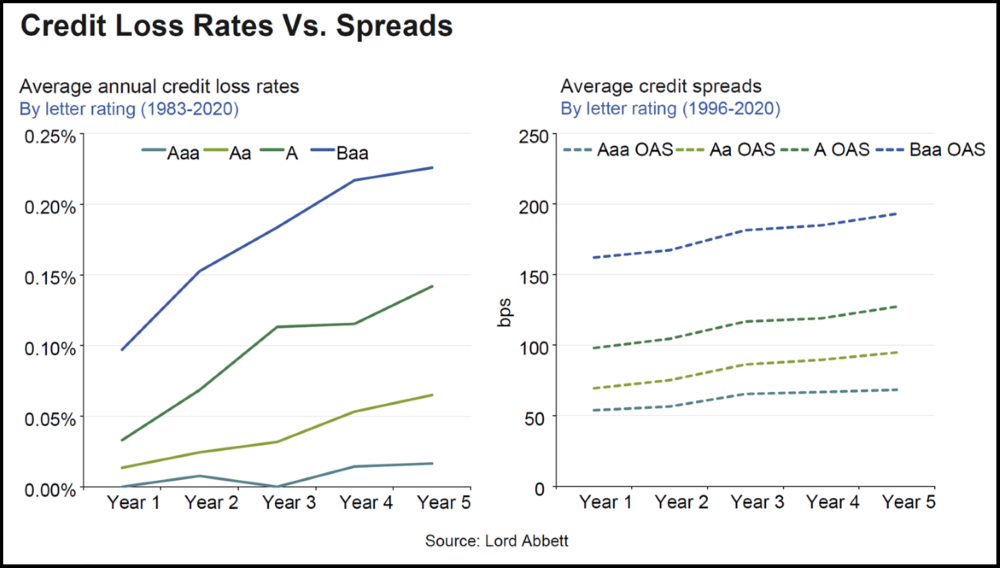

- Mr. Graham acknowledged the real risk of principal losses, but noted “one way to look at it is to compare the term structures of losses vs spreads: the spreads more than make up for the losses.”

- In the chart below, average annual credit loss rates, especially in the first three years, are relatively low for high grade investments, and are offset by spreads over the same period.