NeuGroup BankTPG members hear ways to manage their balance sheets amid low interest rates (that may remain low a long time).

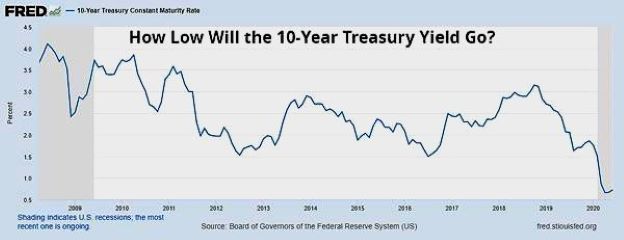

The Federal Reserve announced in early June that it would keep its benchmark interest rate near zero through 2022. While this might be good for borrowers, what does it mean for lenders? And are negative rates possible?

The first question has many answers, as members of NeuGroup’s Bank Treasurers’ Peer Group (BankTPG) heard at the 16th annual meeting. There were several strategies suggested by the meeting sponsor on what bank treasurers can do to manage the balance sheet amid this uncertainty. The answer to whether rates go negative: it is unlikely (see below).

Like the Gershwin tune. “Low rates are here to stay,” one member of the BankTPG meeting sponsor team said, and thus would remain a challenge for banks. “Not a lot of yield to be had here,” he added. The bankers suggested that as with their own balance sheet, members should think about pass-throughs.

- “Given current mortgage rates, prepayments may increase and remain elevated, suggesting that bank portfolios should purchase lower dollar price assets in pass-throughs,” the sponsor said in a presentation.

Real estate could help. BankTPG members were told that GSEs Fannie Mae and Freddie Mac could be facing reform soon, although COVID-19 may delay things. Despite this, the housing market should stay strong, according to the meeting sponsors. Commercial real estate could be problematic but low rates could mitigate the impact.

- “There could be some challenges to commercial, but looking at it overall, it’s not bad because of low rates,” said one member of the sponsor team. “There are plenty of people with dry powder to buy in distress and otherwise.”

Protect against volatility. Another strategy for the remainder of 2020 suggested by sponsors was to protect downside risk with hedges. “Shifting from linear derivatives into hedges with positive convexity like interest rate swaps may be risk accretive at current rate levels. Also, “as implied volatility hits multi-year lows, 0% strike interest rate floors and interest rate collars have become powerful hedging tools.”

Certificates of deposit. The sponsor said some of its clients are investing in bank CDs with customized coupons. “There’s some risk there so don’t do in large size,” the sponsor suggested.

Floating-rate SOFR. With the Fed’s Secured Overnight Financing Rate (SOFR) gaining traction, there have been many entities, including GSEs Fannie and Freddie, banks like Goldman Sachs, Credit Suisse and Bank of America issuing SOFR-referenced floating rate notes. The BankTPG sponsor said that despite this, SOFR FRNs are not that popular.

- On the other hand, the bank is “supportive of the move to SOFR; the transmission mechanism is good,” the sponsor said. Nonetheless, “it raises a lot of questions on how you want to be positioned right now.” And in terms of FRNs, “anything out there that is a lottery ticket if rates go negative.”

Negative rates? The sponsor said negative rates in the US are unlikely, and members agreed. Across the NeuGroup network, the consensus is that US rates, while remaining near zero, will not go negative.

- “Our bank is trying to be disciplined and mechanical,” said one member who was reviewing whether to “unwind and reposition things” in case rates go below zero. The sponsors added that their bank was “trying to be disciplined and mechanical” about the market.”