With flexibility in both bank file types and system compatibility, TIS can be the key to a “best-of-breed” approach.

Fernando Tenuta, an assistant treasurer at the staffing solutions provider ManpowerGroup, knew he was in for a steep climb when he was tasked with digitizing treasury and assisting with a cloud-based ERP. But he got a lift in the form of Treasury Intelligence Solutions (TIS), a bank connectivity aggregator whose solutions are specifically designed to make this kind of process simpler.

- Before this project, Mr. Tenuta was working off of a spreadsheet for central treasury operations. He was intrigued by what TIS calls a best-of-breed approach, a term that refers to employing a number of top-rated applications built on an architecture of interlocking “microservices” with specific purposes, versus the one-size-fits-all solutions that can often come up short.

- ManpowerGroup’s process now starts with TIS, which acts as a communicator between the company’s bank accounts and the rest of its systems, which Mr. Tenuta says has “really reduced” the amount of time his team spends dealing with technology.

- He and Jonathan Paquette, TIS’ head of customer success, described how TIS helped ManpowerGroup develop this solution at a recent NeuGroup Virtual Interactive Session sponsored by TIS.

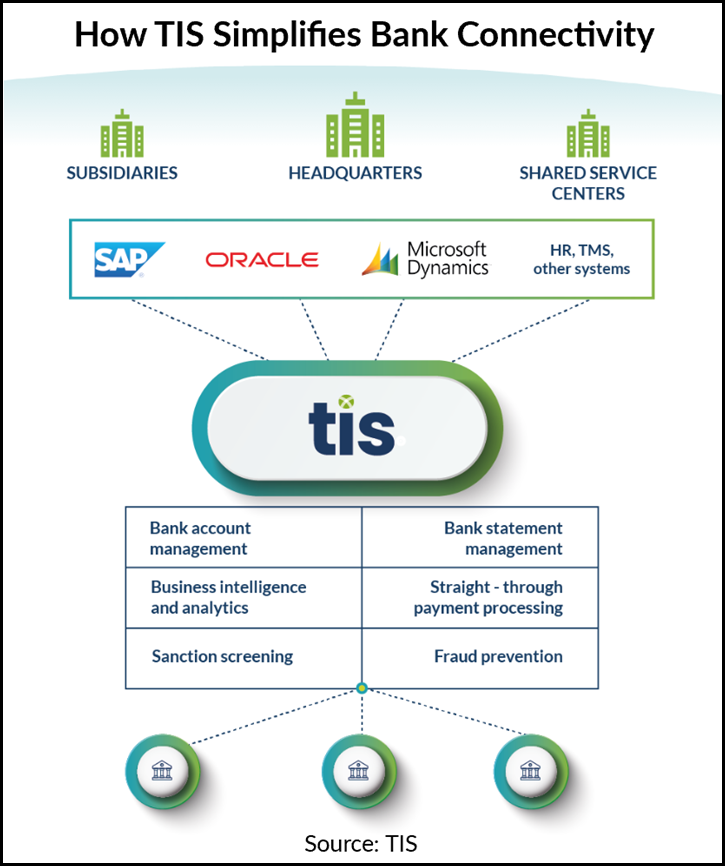

TIS and beyond. In the meeting, Mr. Paquette shared how TIS’ SaaS platform works, addressing both the bank connectivity and file formatting complexities that impede many organizations’ initiatives toward automation and straight-through processing.

- “We connect with all banking relationships as well by any method of the customer’s choosing, whether that’s APIs or local connectivity protocols like EBICS or even SWIFT,” he said.

- As the graphic below shows, TIS sits between a corporate’s various banks and its ERPs (SAP, Oracle, etc.), its TMS and other third-party solutions. This allows for simpler bank account management, analytics and payment processing, among other functions.

A manpower problem. For ManpowerGroup, automated bank connectivity was a primary objective. The company operates in 75 countries and provides work for over 600,000 employees—a sizable operation for a central treasury team with only a handful of members.

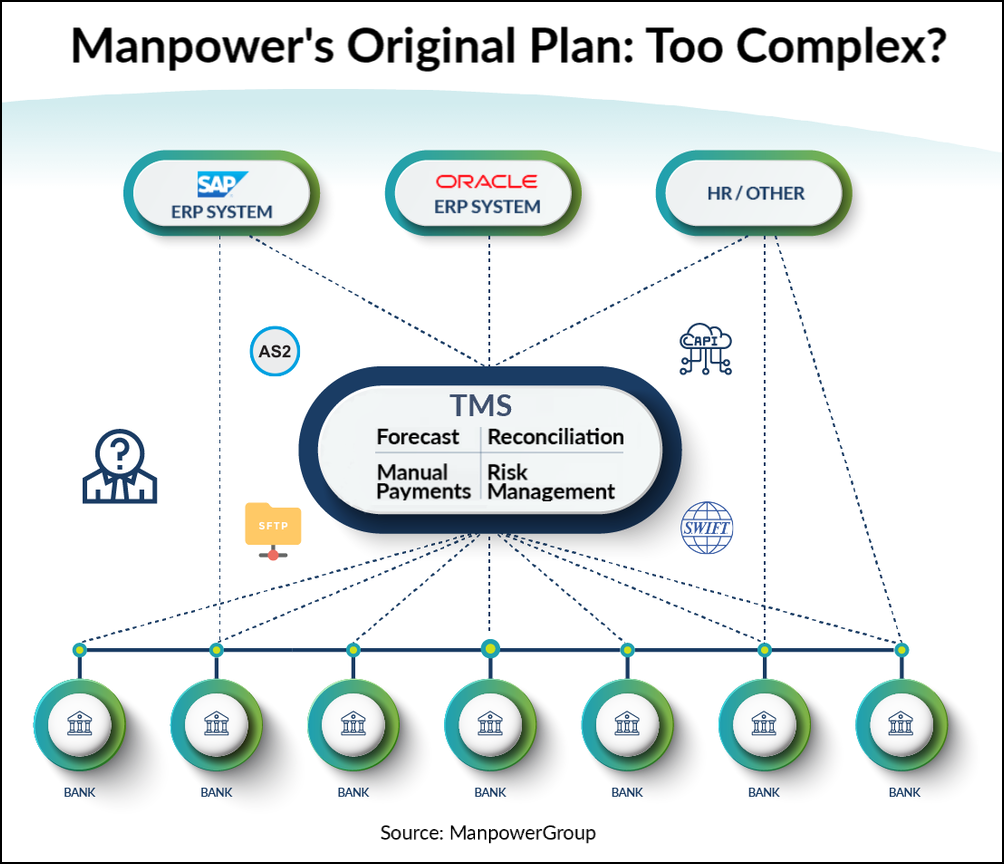

- Although finance functions such as AP and accounting are managed by regional teams, ManpowerGroup maintains one corporate treasury team in Wisconsin that has global oversight over cash management. On top of this, ManpowerGroup was in the midst of rolling out Oracle Cloud Financials, a cloud-based ERP that required complete system and bank interoperability, as well as a bank rationalization project, which required better visibility of accounts.

- Initially, Mr. Tenuta planned out a system like the one below, which would require a central TMS connected to all bank accounts and applications, using a variety of connections and technology. “There is so much complexity of the multiple apps connecting to the banks in different manners,” compared to TIS’ relatively simple architecture, he said.

Plug and play. It wasn’t until Mr. Tenuta’s team worked with industry consultants that it considered seeking an aggregator like TIS to simplify the system instead of relying on a central TMS.

- “We sat down and took a hard look at the TMS landscape and the treasury aggregators and really came to the conclusion that it made sense for us to kind of split the two apart,” he said.

- “That’s when we sat down and created a cleaner architecture, an aggregator in the middle between the banks and our various systems,” he said. “So now, down the road, if we wanted to change a TMS or one of those other systems, it would be easier.”

A simple solution. Mr. Tenuta said ManpowerGroup is already reaping the benefits of time saved and processes streamlined by TIS.

- “Our Oracle team only has to build one XML file, and it’s exported from Oracle and it’s transferred over to TIS,” he said. “From TIS, they’ll translate it into the bank-required format in whatever country we’re in.”

- This significantly helped ease the implementation for the company’s IT department: Once they build the initial file, they can transfer it to TIS, which does the rest of the work.

- “And then we’ll get data coming back from the banks through TIS and then back into Oracle: prior-day reporting, credit notices, payment file notifications, things of that sort.”

- In addition, “TIS enabled smooth connectivity and a full implementation of a TMS, moving from an Excel-only solution,” he said. “TIS account connectivity greatly increased global cash visibility.”

TIS impact. As an unexpected benefit of TIS, Mr. Tenuta has found that the platform provides an agile on-demand source for bank connectivity to address a variety of unforeseen needs.

- When government regulation in Singapore changed and required the company to pull an outsourced transactional process back in-house, he was able to quickly implement a solution that accessed existing bank connectivity through the TIS platform.

- Moving forward, Mr. Tenuta sees considerable opportunity to standardize legacy connectivity processes put in place by the regional teams by incorporating them into the TIS connectivity hub. The file formatting capabilities of TIS also allow him to easily upgrade the legacy file formats used in these processes to more modern ISO XML standards.

- In these ways, Mr. Tenuta has established a solution that will both support future bank and system changes as well as provide immediate solutions to unforeseen bank communication needs.

Sponsored by: