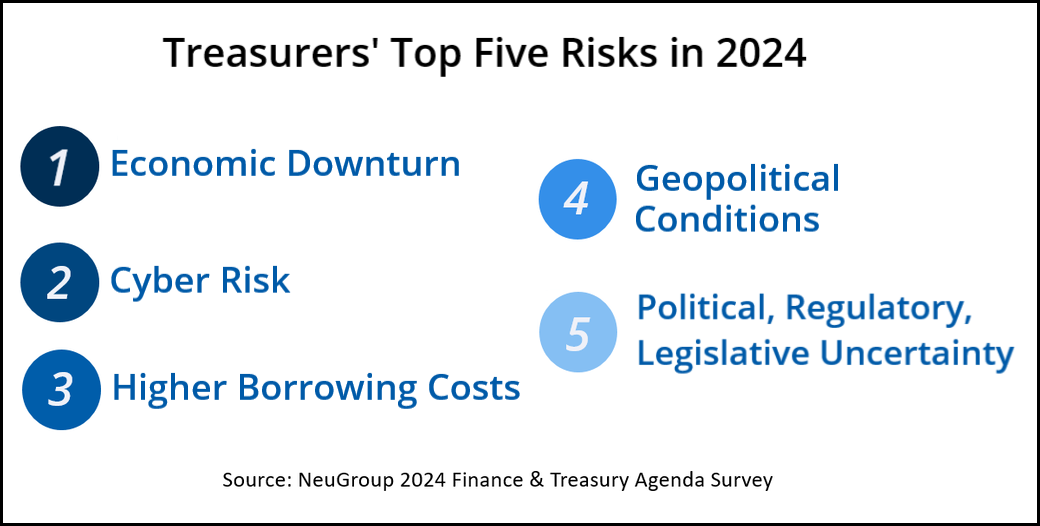

New NeuGroup Peer Research reveals the risk of an economic downturn and high interest expense loom large.

As treasurers look ahead to 2024, the results of the NeuGroup 2024 Finance and Treasury Agenda Survey reveal two intertwined risks—headwinds which may also appear at odds with each other—looming on the horizon: the continuing threat of recession, paired with interest rates that may remain higher for longer. Normally, of course, economic weakness brings about lower rates. But the last few years have been anything but normal.

Economic downturn ripple effect. So although more observers believe the Fed may be able to navigate a soft landing following the recent cycle of rate hikes in the US, members’ top risk headed into 2024 is the same as it was headed into 2023: economic downturn.

- “I continue to see a great deal of uncertainty ahead that requires one to consider downside scenarios persistently in their thinking,” one member told NeuGroup Insights in an email. “The global economy is going through multiple major transitions and events are affecting economies in uneven ways and increasing overall fragility.”

- NeuGroup senior executive advisor Paul Dalle Molle, who leads NeuGroup for Growth-Tech Treasurers, noted that fast-growing companies with credit ratings below investment grade are particularly vulnerable to the risks of tightening credit markets that would most likely accompany an economic downturn.

Perfect storm. A potential recession, or even persistent declines in consumer spending, could put higher pressure on working capital—an issue which could compound if interest rates remain high, keeping borrowing costs elevated as well (members’ No. 3 risk for next year).

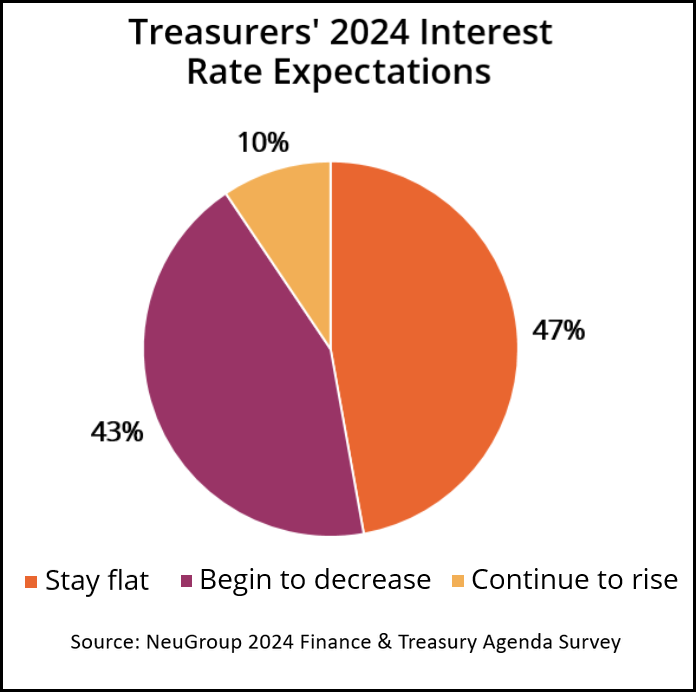

- Over half of survey respondents expected interest rates to stay high or continue rising (see chart)—an issue that could portend weaker earnings, margin pressure and intensified calls by stakeholders to cut costs. To be sure, volatile markets and the recent decline in rates have no doubt altered rate expectations for some members—for now.

Political fallout. NeuGroup members also expressed apprehension about political impacts, including geopolitical volatility and uncertainty around regulation.

- Ongoing armed conflicts in the Middle East and Eastern Europe will continue to disrupt business in the new year. Other concerns mentioned by members include fallout from Argentina’s election of a president who promises to upend the status quo and another polarizing presidential election in the USA.

- More restrictive regulation in the US on clean energy requirements may also follow in 2023, along with proposed tightening to Basel III and potential changes in Fed stress-test criteria in the wake of the banking crisis earlier this year.

- “Fundamentally, I remain optimistic, but with a heightened sense of risk and urgency,” one member said. “For treasury, it’s a good moment to reflect on risk management. Take the time to review exposures, strategies and processes.”

The cyber element. We should note that members ranked cyber risk No. 2 in the survey. Earlier this year, a Deloitte poll showed that over one-third of corporates had faced a cyberattack over a 12-month period.

- In recent meetings, a number of members have shared how they are stepping up cybersecurity procedures within treasury, because insurance for cyberattacks is often too expensive.

- One member shared that his company has regular drills in which the entire office shuts down its computers and switches to using spare, encrypted laptops for the day.