Standard Chartered advises keeping an eye on China as accelerating use of the RMB helps the nation separate itself from the pack.

In a recent meeting of NeuGroup for Tech Treasurers centered around China’s economy, Standard Chartered’s global head of research Eric Robertsen kicked things off with an anecdote. Just over ten years ago, a Congo-based wood supplier had its supply of wood bought out by a Chinese business that paid in USD. Just three years later, Chinese businesses were still buying out this supplier but paying in RMB.

- “I think that narrative is becoming directly applicable to the world today as we think about the evolution of China, Asia and the currency payment world,” Mr. Robertsen said. “What China is doing is creating parallel universes in a number of different areas across a number of different platforms.”

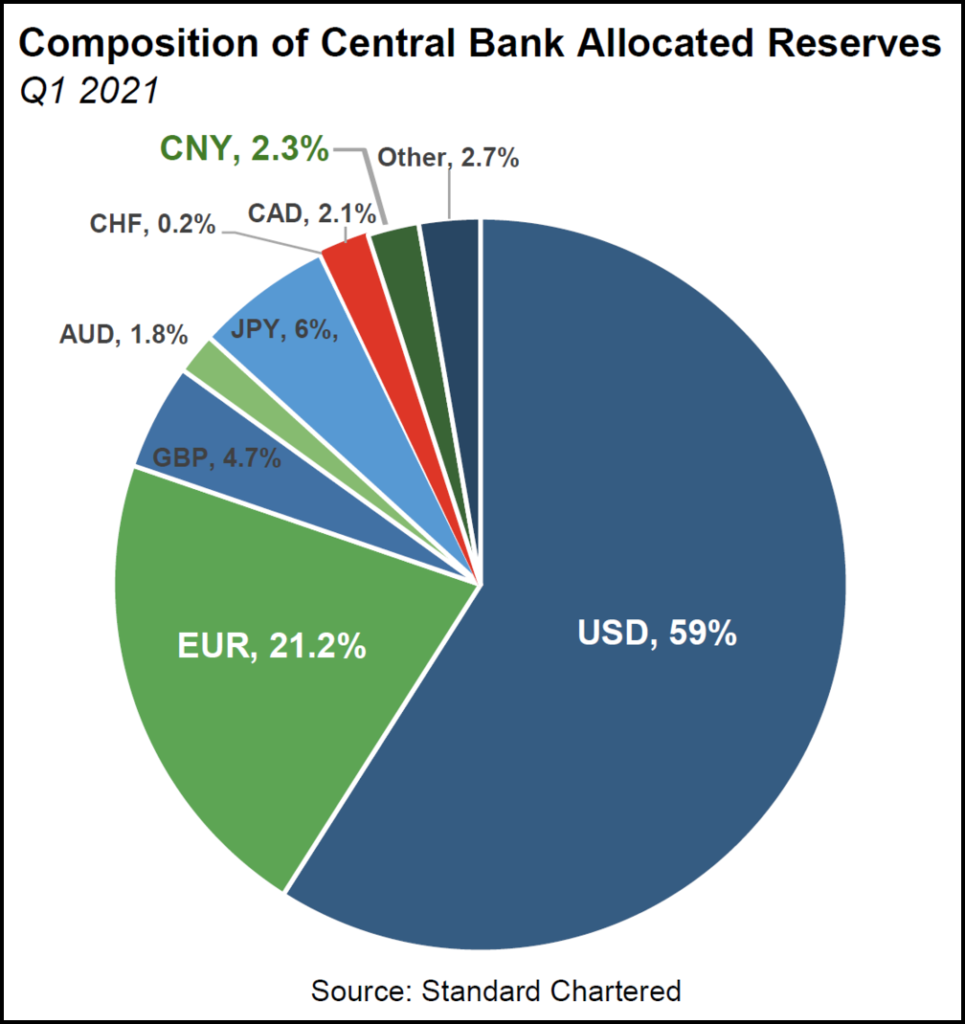

RMB as a reserve currency. Currently, the RMB (CNY) only makes up about 2% of allocated central bank reserve management portfolios, with the dollar at just under 60% and the Euro at roughly 20% (see chart).

- “And yet, we all know how important China is to global trade,” Mr. Robertsen said. “I argue that the CNY weight is much too small relative to its usage in the overall market. So there is a benign but extremely interesting and structural trend: the growing relevance of RMB and RMB-denominated assets in global portfolios.”

- One member expressed skepticism that the RMB could be a “freely floating” reserve currency in the near future, despite China’s ambitions. Mr. Robertsen responded that just five years ago, the notion of big inflows into China’s bond market was nonexistent, and today, those flows have increased to such a magnitude that China is actually able to start allowing less restricted outflow of capital.

- “But I don’t think they’re quite there yet, they’re still not a freely floating currency,” Mr. Robertsen said. “When do they become a reserve currency in practice? Probably five years. The IMF has already labelled CNY a reserve currency but in practice, they still have a way to go.”

- A more cynical view is that China seeks to replace the dollar as the global reserve currency and that its pursuit of a digital currency is a way to work around the dollar system, but Mr. Robertsen doesn’t subscribe to that theory.

- “I think what they’d like is to have separate ecosystems, and in each to have their trading partners using RMB exclusively,” he said. “And that also gives them quite a bit of protection should US-China or Europe-China political tensions escalate.”

China for China. Internally, multiple members have said they’ve begun “decoupling” their China operations team from the rest of their global team, essentially treating the nation as its own region to deal with the increasing complexity.

- “There’s a view that China is big and important, and there is going to be growing investment and capacity to serve China,” one member said. He said the flip side is that there will be increasing investment in supply chain for growth outside China and the rest of Asia.

Supply chain impact. “Manufacturing platforms in China to serve other parts of Asia is something that is trending away,” the member said, but it’s not something that will happen immediately.

- “What we have seen in our conversations with clients in Asia is that supply chains are being shifted” away from exclusive reliance on China, Mr. Robertsen responded. “There has definitely been a gradual migration to diversify supply chains.”

- “If you have a corporate campus in Shenzhen of 200,000 employees, moving that to Vietnam doesn’t happen in a heartbeat, these are long-term processes,” he continued. “The idea that corporates will shift entire supply chains from China immediately is misleading,” but the change is happening.