Regular monitoring and analysis of metrics can help identify areas of strength and weakness, and ensure efficiency.

Treasury performance metrics are crucial for corporations as they provide a framework for assessing the efficiency and effectiveness of their treasury operations. They serve as a window into how well the treasury team is functioning in a variety of areas, from cash management to payments to foreign exchange. At a recent meeting of NeuGroup for Mid-Cap Treasurers, one member gave an updated presentation on how his team utilizes key performance metrics.

- The presentation specifically focused on global cash management, bank account reduction, payments, bank fees, collections, FX, credit card processing and insurance. Despite this long list, the member stressed the importance of not overwhelming the team with too much data and regularly revisiting the metrics to ensure they’re useful.

- The quarterly reports generated are used more for operational purposes than for the CFO, focusing on functional units like accounts receivable and accounts payable (AR/AP).

Constant vigilance. In terms of global cash management, the member emphasized the need to monitor weekly performance, track the number of bank accounts closed, the interest earned and invested cash. The analysis also identified a build-up of excess cash that was set aside and used for a major acquisition.

- The company has been actively reducing its bank accounts through a rationalization project and was able to eliminate 300 in 2018. However, a continuous string of M&A deals over the years kept the number of accounts growing.

- For example, the above-mentioned acquisition brought 1,100 new bank accounts, which the member and his team have been able to trim to 850. Nonetheless, he said, “we’re back to square one.” The goal now is to continue eliminating unnecessary accounts and banks.

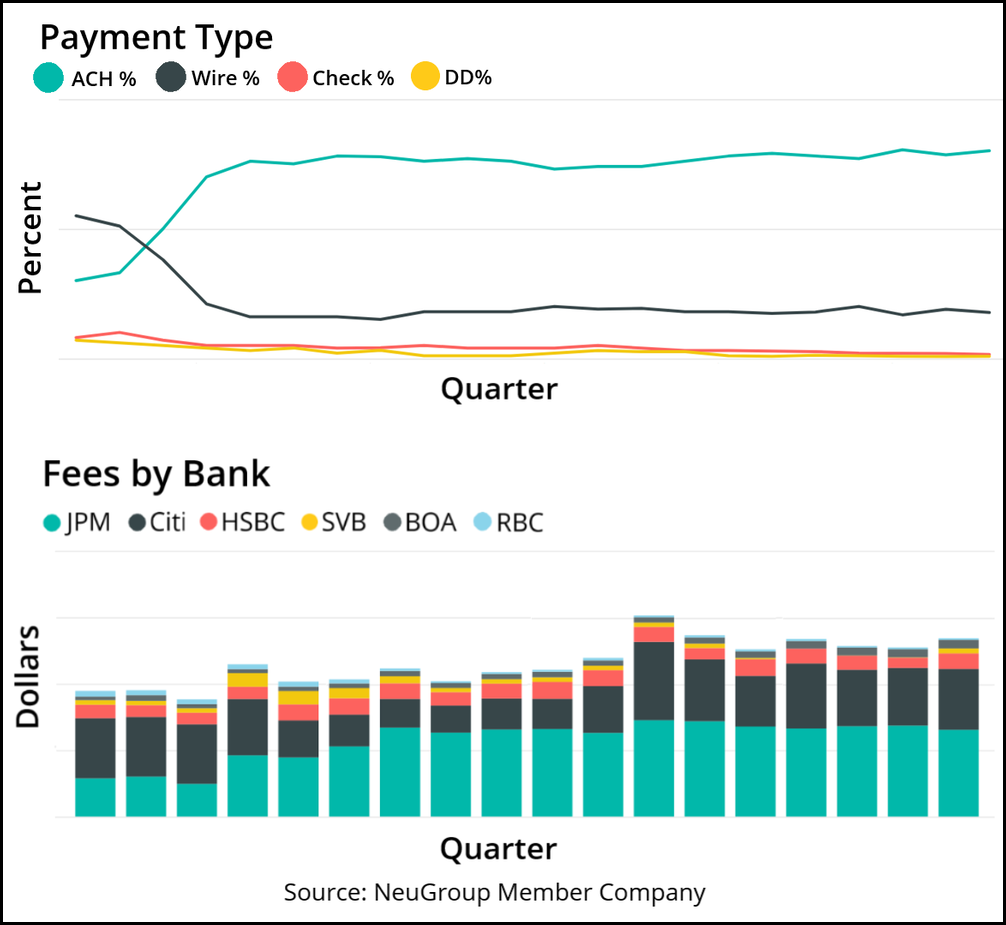

Fee reduction. Payment analysis focused on ACH, checks and wires (see charts above). The aim was to reduce wire payments and increase ACH payments for cost savings. Similarly, bank fees were monitored closely to ensure parity among different banks.

- The member highlighted the team’s collection efforts and the need to balance various methods and analyze associated costs like lifting fees for international wires. The company had also transitioned some business operations from the UK to Ireland for cost savings.

More cost reduction in FX and credit cards. Foreign exchange was another major treasury concern, with a focus on notional FX and ensuring costs were minimized by using platforms like FXall or Bloomberg for transactions.

- The company also tracked credit card processing costs, authorization rates and chargeback percentages, aiming to improve key metrics and reduce fees.

Insurance was another area of focus, with a team dedicated to contract reviews and managing insurance certificate requests.

The final discussion touched upon the idea of whether liquidity measures and bond trading status should be included in the performance metric reports. The presenter suggested a separate deck might be appropriate for these more financially oriented metrics.