Smart treasuries are building and testing solutions to drive transformation, not waiting for cloud-based ERP implementations.

By Joseph Neu

NeuGroup’s 2024 Treasury and Finance Agenda Survey provides a backdrop that helps illuminate how smart treasuries are not letting what I have dubbed the “cloud stall” impede their progress toward digital transformation. The stall occurs when treasury waits for an enterprise to implement a cloud-based ERP—and the treasury functionality ERP vendors are developing—to drive technological advancement. By contrast, smart treasuries are taking advantage of the waiting time created by the cloud stall to experiment and build their own solutions, sometimes with help from internal and external resources.

- These treasuries are implementing a new-generation of cloud-based applications that can be deployed quickly, are relatively inexpensive and integrate well in a cloud architecture to analyze data to drive decision-making. They provide an example of what others would be well advised to emulate to avoid a stall that sends the treasury plane falling from the sky.

- Recent examples of how smart treasuries at NeuGroup member companies are pushing ahead with self-built treasury technology solutions include a yearslong project at a large manufacturer to transform cash forecasting with the help of data scientist “wizards” who have built a number of algorithmic models based on statistical time theories, machine learning, neural networks and regressions, among other tools.

- These and other examples, including treasuries building their own data dashboards using Tableau and Power BI or bolting on solutions from third-party vendors, have implications for ERP providers: They may find that their efforts to advance functionality for treasury, aiming to fulfill a longstanding goal to make a dedicated treasury management system (TMS) obsolete, will be too little, too late in comparison to what treasury teams implement while they wait.

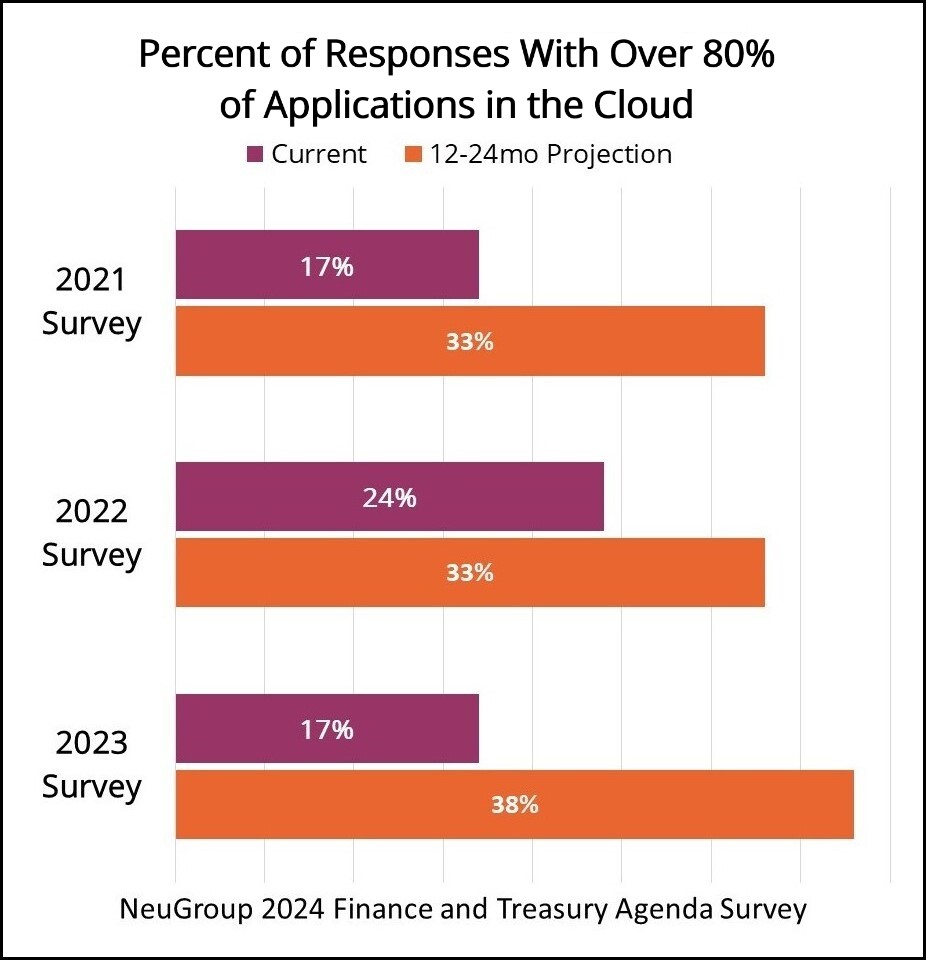

The survey backdrop: unrealized expectations. Every year, treasurers predict a significant migration to cloud-based applications, yet adoption is not keeping up. As the chart below indicates, the percentage of NeuGroup members with over 80% of their current finance applications in the cloud is not keeping pace with the expectation to reach that threshold over the next 12-24 months.

Based on discussions with members during 2023, I believe the lengthy timelines for cloud-based ERP migrations may be to blame. You are doing well if you go live on the third scheduled go-live date, and usually that involves compromising on going live with all the desired treasury functionality. Plus, while more enterprises are being convinced that a cloud-based ERP will allow them to forgo a dedicated TMS, the timeline for the ERP implementation causes many to end up making the case for a cloud-native TMS anyway.

Time for TMS transformation. Current cloud-native TMS adoption has barely changed since 2022, although the survey shows that the vast majority of respondents (56%) expect to have a cloud-native TMS in place over the next 24 months, and 43% already have one.

- Even here, traditional TMS providers may see market demand disrupted. This speaks to a lack of implementation resources and longer-than-expected timelines for new application rollouts and upgrades. These may not be as long as with ERP installations; but the question is whether TMS vendors keep up with the pressure for digital accelerations.

Smart automation. While cloud migration has stalled, the implementation of smart automation solutions rose sharply between 2022 and 2023, with more expected this year. Some of the most significant gains were in tools that eliminate manual intervention to free up staff to focus on value-creating work like decision support.

Year-over-year:

- RPA adoption more than doubled.

- Advanced analytics solutions adoption surged from 7% in 2022 to 17% in 2023.

- AI and machine learning jumped from no current adoption to 13%.

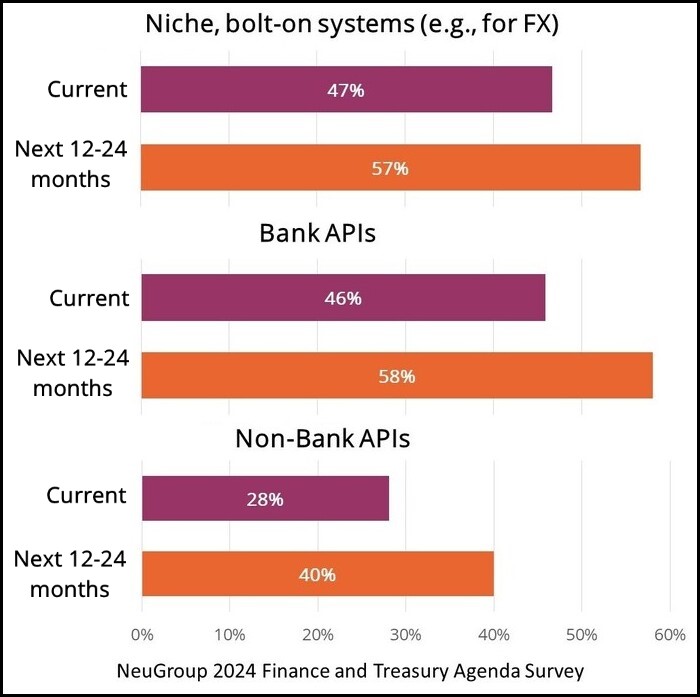

Niche systems and API connectivity on the rise. Comprehensive systems change may be lagging, but niche systems enabled by cloud-based application integration or fed from data lakes show a significant rise. The same can be said for API connectivity in general, showing a significant rise in adoption (see charts).

If the niche systems play well with data from other sources and enjoy API connectivity while delivering the functionality leading treasuries seek, it will be easier to retain them once ERP projects are completed—if they are competitively priced. Moreover, the new niche systems may be modules of a single provider that may all but replace the need for a traditional TMS.

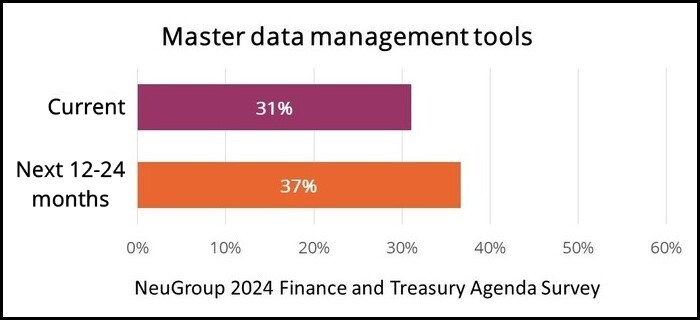

Mastering the data. Meanwhile, treasuries are focused on mastering data. Bringing it from a variety of sources, including out of the stalled ERP upgrade, into a data lake or warehouse is a major part of this. But the more important piece is master data management. As the chart below shows, less than a majority of respondents will have adopted master data management tools over the next two years, with 31% having them currently.

- That needs to change. If you have the data housed and mastered, plus tools to analyze it, workflow automation to execute transactions from it and a governance and control overlay, what more do you need?

Final thought. Here’s the big risk for traditional software vendors, starting with ERP providers that are not keeping pace with digital acceleration: Their treasury customers will pull out of the stall and decide they’re flying higher than they would if they waited for a finally-ready-to-go-live, cloud-based ERP. I doubt treasury is alone with this trend. Of course, if all the applications play well with each other in the cloud, then everyone can still win.