Deutsche Bank veteran Suman Chaki explains a strategy of developing bank-agnostic solutions with tech partners like TIS while continuing to invest in proprietary tools to solve problems faced by corporate clients.

Deutsche Bank managing director Suman Chaki has an impressive and extensive record of advising corporate clients and helping them solve a variety of cash management challenges. So it’s no surprise that his insights and perspective on what treasury teams at multinational corporations want and need from banks, and how Deutsche Bank is responding with bank-agnostic solutions co-developed with tech partners like TIS—as well as the bank’s own proprietary solutions—are compelling.

Mr. Chaki’s views are informed by deep experience in corporate banking at Deutsche Bank, where he has worked since the beginning of his career. He joined the bank in 1997, straight out of business school in India, and helped build what is now one of Deutsche Bank’s strongest cash management franchises globally. (Mr. Chaki studied electrical engineering as an undergraduate and worked as an engineer before deciding an MBA would open new doors.) Today, he’s global head of cash management structuring—an advisory function—and head of cash management sales in America.

His resume includes a decade of running various Deutsche Bank units in the Asia-Pacific region from the bank’s Singapore hub, including supply chain finance, working capital advisory and cash management. In 2020, he left Asia and moved to New York—a boon for US-based multinationals that can now tap Mr. Chaki’s wealth of knowledge about Asian markets where Deutsche Bank is an industry leader. His move exemplifies how Deutsche Bank provides executives with opportunities for professional growth, benefiting the individual and helping the bank retain top talent across the globe.

The two hats Mr. Chaki wears—one tailored to sales, the other designed first and foremost around understanding and solving client problems—allow him to paint a complete and nuanced picture of Deutsche Bank’s commitment to serving corporates on multiple levels. Mr. Chaki sat down recently with NeuGroup Insights for two virtual interviews to explain the cash management strategy. The interview has been edited for space and clarity.

Global Head of Cash Management Structuring and Americas Head of Cash Management Sales

NeuGroup Insights: Suman, let’s start with Deutsche Bank creating a cash management ‘structuring’ business. What is it and what’s the mission?

Suman Chaki: We set this up two years ago, while I was still in Singapore, as a critical global function—primarily to help our treasurers at large, global, complex multinationals through their transformation journey, the treasury 4.0 transformation. We’ve continued to increase the focus on how we can help their businesses around the world, which is why cash management has become so much more the focus of the corporate bank.

Through this advisory approach, we began hearing our treasurers a bit differently. We are trying to understand and appreciate the treasurer’s challenge a bit deeper rather than—and this is a big difference—immediately starting to think of product.

When I put on my structuring hat, my advisory hat, in front of clients, they are more open to sharing because I generally don’t want to sell them anything. I want to bring to them what we see other corporates doing, how we benchmark vis-à-vis the industry, how we understand what they’re doing, how we can guide them through the transformation process, including technology solutions that can help them.

To do that, we’ve started leveraging our client advisory board more proactively, in a way we haven’t in the past. Now, we often approach client board members on a bilateral basis and I’m very impressed with the way dozens of corporate treasury teams have made themselves available to share treasury challenges and current gaps.

That’s one of the reasons we set this team up. It’s not just about positioning Deutsche Bank products and solutions. At the end of this, we really want to approach the treasurer as an advisor who sees us as a trusted partner in the entire treasury transformation journey.

NGI: You say that treasurers are viewing that transformation journey—and the role of banks in it—differently these days, in part because of the pandemic. What do you mean?

SC: I think during the Covid phase, treasurers got a bit of time to sit back and withdraw from the day-to-day, and look at the real challenges that they’re facing in the current world and in the future. Weaknesses and inefficiencies in systems, processes and technology were exposed.

Now they’re looking and asking, ‘Do I have the right platforms and solutions, am I future-proof?’ They have to look internally and figure out what are their pain points. Then they have to figure out, ‘Can a bank help, can a technology company help me with that future-proofing journey over the next five to 10 years? Can I do it internally? Or is it a combination of all of that?’ My view is that’s what a lot of treasury organizations are doing today.

As a result, I have the feeling that that large, traditional and legacy RFP volumes will start coming down because the treasurers will start thinking, ‘Will changing a bank necessarily solve those problems? Or does the problem lie somewhere else?’ Just changing banks without addressing inherent challenges is not going to give them the biggest bang for the buck.

Rather than the standard cash management topics, we will see more inquiries from corporates on topics related to their rapidly evolving business models and the shifting technology landscape. It’s about banks helping clients identify and solve pain points. So banks will continue to be an important partner to corporate treasury organizations. It’s just that the role they play will increasingly look different.

The other thing that’s evolving very fast in my view is that as corporates focus less on traditional banking topics, they will start looking at more bank-neutral and bank-agnostic solutions. They’ll also start looking for ‘best-of-breed’ solutions for specific problem statements that are not necessarily being addressed by their existing ERP or TMS platforms.

NGI: That brings us to Deutsche Bank partnering with TIS, which operates a payment platform, on a bank-agnostic fraud solution—the first part of a broader initiative to develop and distribute multibank services for treasury and finance teams. But you’re doing this while continuing to offer proprietary solutions?

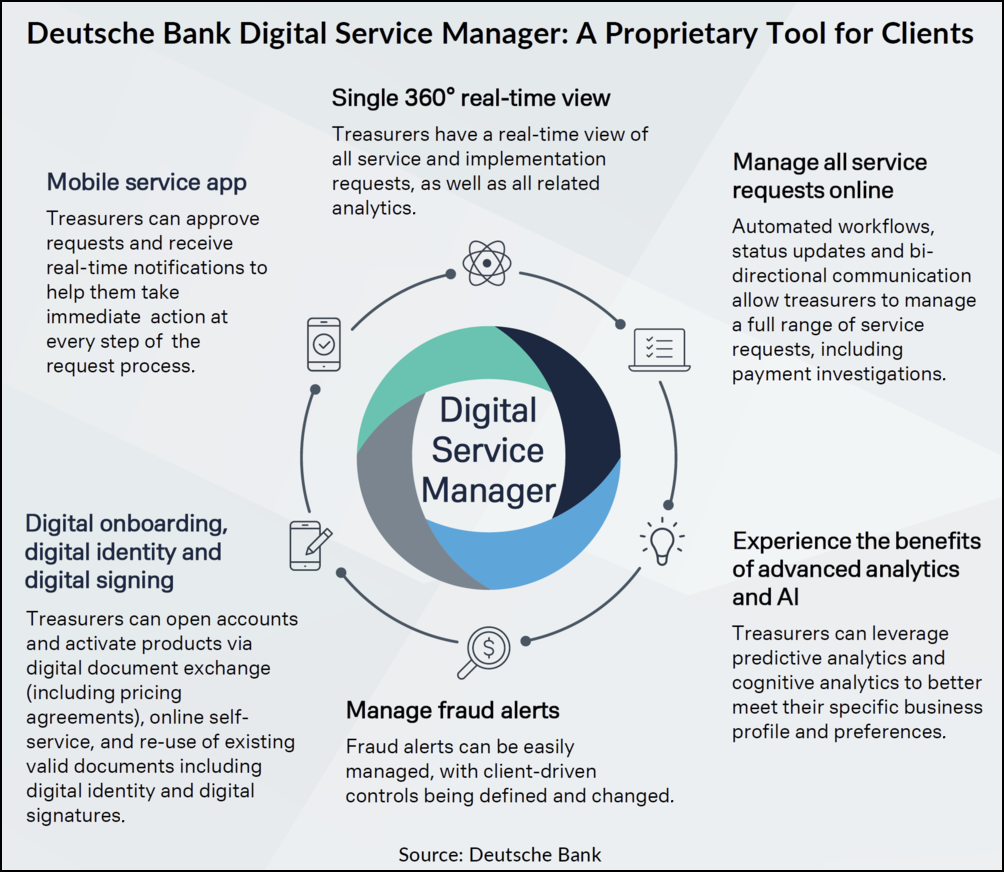

SC: This is going to be a journey, don’t get me wrong. For the foreseeable future, banks will need to continue to invest as much as they are now in their own proprietary offerings. So we will keep investing in proprietary solutions—like our NextGen cash manager, our Digital Service Manager, digitizing all interactions with the bank. So we keep doing that and offering it to our clients.

But as technology at corporate treasuries gets more mature, as companies start investing in their own data lakes and their own platforms, they will want to have more bank-neutral solutions. So in parallel, we want to start looking at offering bank-agnostic, bank-neutral treasury technology solutions co-developed with and offered through tech partners.

We think of it as treasury technology as a service—best-of-breed technology solutions. These products are being built on the back of feedback, of ideas coming from those large, global, multinational complex treasuries we’re talking to in our client advisory board and every day. We want to solve their problems through the co-development of solutions.

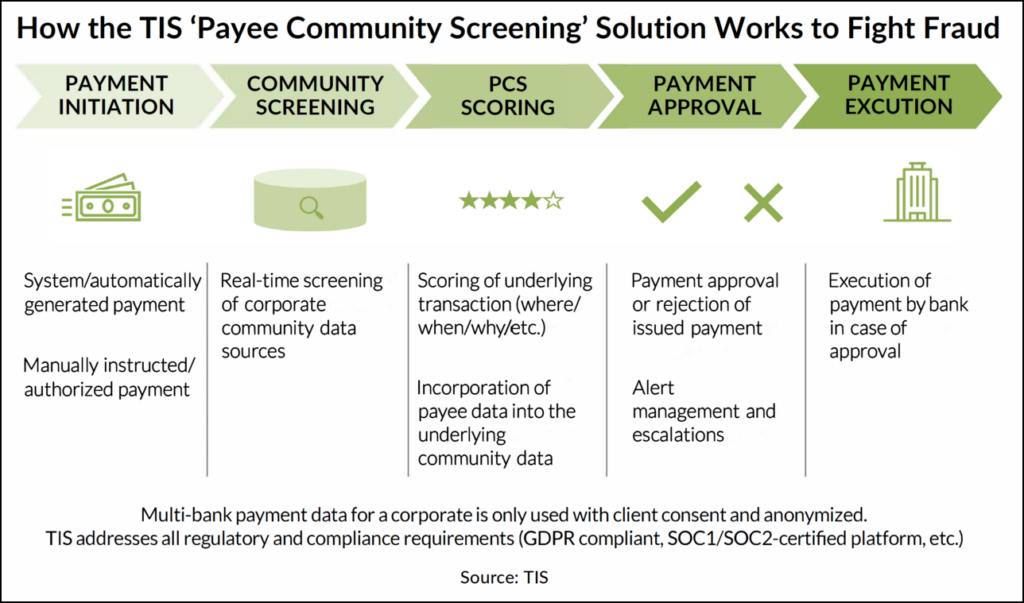

This is where the fraud tool with TIS comes in as an example. Clients have a payment fraud problem and they need a solution for it. But they need it across all banks. Also, the various bank account validation solutions available from third parties in different markets around the world do not fully protect against sophisticated vendor payment fraud often referred to as business email compromise, or BEC.

NGI: What payment fraud pain point does the tool address that isn’t already covered by Deutsche Bank’s robust security technology that flags potentially fraudulent payments before they’re made by the bank?

SC: All proprietary bank fraud management solutions have the limitation of working only with client data that’s available in a payment file, without having access to the client’s contextual data. But if we could provide the client a utility, for example, that operates in his environment and checks the file before it’s sent to any bank, then the program could access a lot more rich client data to flag a potential fraudulent transaction—before anything leaves his premises. Additionally, the client would get the benefit of the ‘community effect’ of such a cloud-based solution.

NGI: Can you explain how this community effect and ‘swarm intelligence’ benefit multiple clients, regardless of what bank or systems they use?

SC: Yes—as the software is used by more and more clients, there is a network effect. The more the software gets used—and that’s the benefit of the cloud—the more it learns and the more everyone benefits from the community. effect. That is not possible with a pure banking solution or if the client does it themselves.

NGI: But is this model of partnerships with tech companies like TIS really different from the white labeling that banks have been doing for a long time

SC: We’re saying this is different. We want to offer this product to a client not through Deutsche Bank but through an independent entity in which we may or may not have a direct interest, a third party. It could be a tech company, could be a JV, could be something else. And that product is offered as a pure technology product to the client, not as a banking value-added solution.

It’s not about a product built by a tech company and we’re white labeling it. And it’s not that we’ve made an investment and we are a passive player. Here, we are collaborating to co-build and co-develop a product with a tech company that’s a stand-alone, bootstrap solution that has its own life that we should be able to charge a fee for. It’s something we could have built ourselves. But the reason we’re not building it ourselves is that it is less useful for treasurers to use a bank proprietary product. Then he or she will need it from every other bank.

I don’t think there are too many with that specific approach that have been out there in the market; we want the treasurers to understand why this is different from the traditional white labeling.

NGI: How do the tech companies—that you need to partner with to build bank-agnostic solutions—benefit from collaborating with you, the bank?

SC: For DB, it starts with 150 years of experience and world-class IP. It’s about bringing to the tech partner the bank’s knowledge repository around payment, around liquidity, around regulation; how can we bring that into the platform of the tech company? Since in many cases we are already building solutions for our portal—like in the fraud case—we can also use some of that knowledge to further help build out the bank-agnostic tools, leveraging the value of our expertise.

The idea is finding where the bank’s expertise and the tech company’s programming, agility and flexibility come together to create multibank solutions that address widespread problems for clients. Those are the winning cases.

The bank has to have something so unique that a tech company by itself will not have easily. A simple example is the knowledge of what it takes to open a bank account in a rapidly evolving global market: What it takes to update signatories, nobody will ever know as well as a bank will know.

NGI: Speaking of that, do you expect bank account management could be an area of possible bank-agnostic treasury technology solutions?

SC: In our journey to create bank-agnostic or multibank treasury technology as a solution, bank account management is another use case, where there are significant challenges corporates face, for example, when they have to make an alteration or modification around signatories, where what the bank needs varies from market to market, bank to bank.

Clients are asking, ‘Can we have a database of what we need in markets where we are present, where can we update signatory information based on our knowledge into that system?’ None of the bank account systems have that level of intelligence today, based on client feedback. If I need to do a signatory change in Korea, what exactly do I need to do if it is with bank A or bank B and in market C?

When you talk to treasurers, which is what I do in my day job in my treasury advisory role, I find the more complex and global and challenging the client’s business and operations get, the less the standard functionalities of a TMS or ERP are able to meet their unique needs. Many corporates say they want a best-of-breed solution because their needs are unique, and implementation and extraction of data are difficult. That’s what we’re addressing.

NGI: Any other bank-neutral products in the works that you can tell us about?

SC: We’re in the advanced stages of working on a proof of concept, in collaboration with technology partners, for solutions on data-driven treasury for large, global and complex multinational corporates, focusing initially on tools like intraday liquidity and cash flow forecasting. There are many companies for whom an active management of global treasury liquidity positions, across multiple bank providers, is essential. Not just cash but also payments, collections, vis-à-vis, ‘How am I performing [versus] what was forecasted on a real-time basis?’ If that’s what is important for you, that’s what we’re trying to work on.

NGI: Thanks so much, Suman. Please keep us posted on these bank-neutral solutions for treasurers.

SC: Thank you very much. We will—this is the beginning of many more to come. You will see more.