Real-time bank connectivity is the future—but NeuGroup members have yet to embrace APIs.

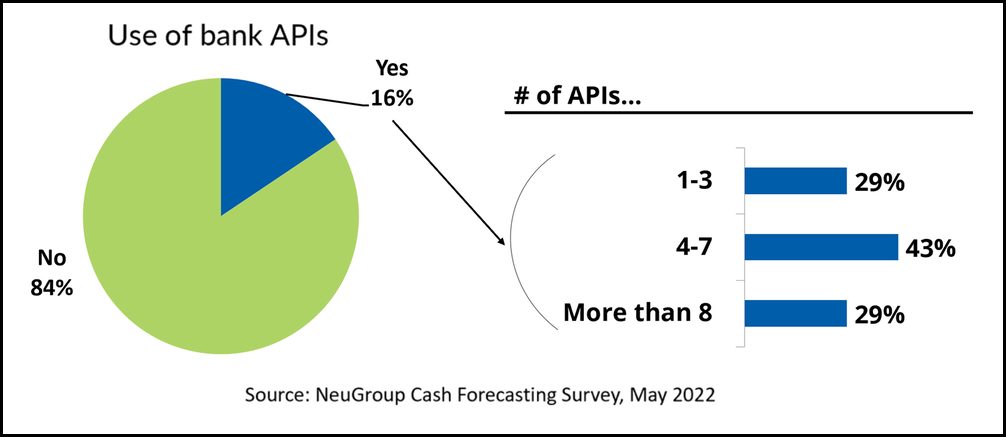

In a recent NeuGroup member survey, 64% of respondents said they currently do or plan to have real-time connectivity to bank data, but only 16% said they’re currently using bank APIs—one critical key to real-time data.

- This is likely due to the overwhelming number of APIs that different banks use, and a lack of standardization. As you can see in the chart below, 29% of members that do use bank APIs employ more than eight.

- There are some innovative aggregation solutions to solve for the number of APIs, developed by fintechs like FinLync, which presented at a recent session of NeuGroup for Retail Treasury.

- Some NeuGroup members would like banks to come together and agree on a standard API protocol, an outcome corporates could push them to achieve faster. Skeptics say don’t hold your breath waiting for most banks to embrace an API standard that requires them to share proprietary information.

Pain points that APIs can solve. A presentation at the session from Mitch Thomas, FinLync’s head of solutions engineering for the Americas, laid out several obstacles that APIs can overcome. Among them:

1. Time-consuming reconciliation

- One member, who recently completed a real-time data project using bank APIs, said the ease of payment reconciliation alone made the project worth it.

- Legacy bank connections require downloading static data from bank portals or file-based (AKA host-to-host) connectivity, like SWIFT. Reconciliation in file-based connectivity is a time-consuming, multistep, manual process in which a corporate’s treasury team downloads a batch of data from a bank and matches each payment in the ERP to the company’s invoices.

- What corporates need, Mr. Thomas said, is the ability to go out to banks and bring data in with APIs. “The detailed order information joined with the bank information creates a perfect storm of reconciliation, allowing line item detail to be automated with AI and machine learning without any manual effort,” he said.

2. Payment traceability

- With legacy bank connections, once a bank processes a payment, the corporate loses track of its status. But bank APIs allow end-to-end tracking similar to package deliveries.

- “For a cross-border transaction, I can track a payment through three different countries and know exactly when that counterparty receives funds,” Mr. Thomas said.

3. Uncertainty around cash visibility

- “Consistently being able to make decisions based off of accurate data has been a big pain point for long time,” Mr. Thomas said, especially when it comes to generating a forecast. Improved cash visibility and up-to-the-second data that can be refreshed as frequently as needed can have an instant impact for corporates that generate frequent forecasts.

Lean on me. The issue that members say holds them back from fully embracing bank APIs is that many banks use unique API formats that, when built in-house, require a heavy lift on integration.

- Though fintechs like FinLync can aid in multi-bank API aggregation by providing a single endpoint for all bank connectivity, the lack of standards keeps some API-curious treasury teams on the sidelines.

- A bank representative that worked with the member who implemented real-time connectivity compared the state of APIs to the development of file-based connectivity, which was significantly improved by regulation and payment standard like SWIFT.

- “There is a drive to do that, and everyone recognizes that it’ll make it easier for overall integration to have standards,” she said. “It’s just an area where there’s got to be more collaboration. In the file space, it wasn’t a quick turnaround either.”