March 2, 2021

Talking Shop: Holding Physical Cash ‘Under the Mattress’

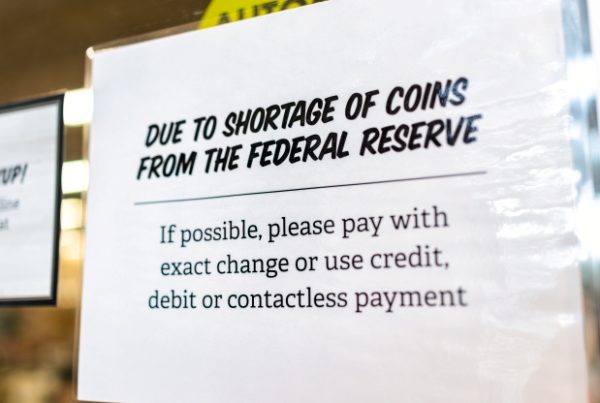

Member question: For business continuity or emergency use purposes, are you holding any physical cash on hand at one of your sites?Peer Survey Results: “No” wins in a landslide.Peer answer: “Our US company does not currently keep any cash ‘under the mattress,’ however I do think there are some places around the globe that do have some . “I’m assuming you are asking this post-Fedwire disruption? Was anyone negatively impacted by that? I am wondering if anyone is preparing any…