ARRC liaison David Bowman explains the implications of SOFR and what corporates need to do now.

Corporate treasury teams that have paid little or no attention to the planned transition from Libor to SOFR, take note: That stance makes much less sense today than last year and “won’t make any sense” by the end of this year, in the view of David Bowman, the senior staff liaison from the Federal Reserve Board of Governors to the Alternative Reference Rates Committee (ARRC).

- Mr. Bowman made the remarks in an exclusive presentation to NeuGroup members Monday afternoon, the first of two such sessions. The second is on Thursday.

- Among the treasury professionals participating in the call, only 35% said their companies have formed cross-functional teams to manage the transition to SOFR, while 35% have not and 30% have plans to do so. In other words, a lot of companies have plenty to do to prepare.

- Mr. Bowman said Ford Motor Co. will be joining ARRC, which already includes the National Association of Corporate Treasurers and the Association for Financial Professionals; less than a third of members are banks. He said that ARRC welcomes the input of nonfinancial corporates in its working groups.

What you should be doing now. In addition to forming cross-functional review teams, Mr. Bowman recommended that members start testing SOFR now through lines of credit, for example. His presentation noted that testing SOFR will help corporates shape how the market evolves and learn what works and what doesn’t. “Waiting means you forgo the chance to shape choices that will eventually impact you,” one slide stated.

Other advice and insights:

- Corporates should participate in the ISDA protocol to amend fallback language in derivatives, and amend or renegotiate fallback provisions in other contracts when opportunities arise.

- Operational changes will take time and planning. New loans, debt and securitizations based on SOFR will require operational updates, especially when using SOFR in arrears, and will have different pricing and margins.

- Changes to internal valuations or other systems will need to be included in budgets, IT project planning, etc. Corporates will also want to make sure that external vendors are making necessary changes and that those changes will meet specific needs.

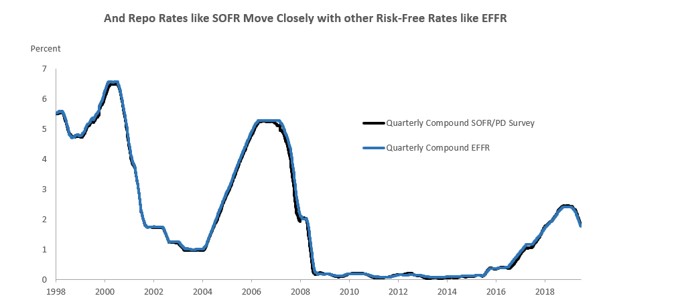

- It’s a misconception that the repo market rates SOFR is based on will move down more than overnight unsecured rates. They actually move quite closely with the fed funds effective rate and the Fed’s monetary policy targets:

Time check. Here are some timeline facts to keep in mind as corporates plan for the SOFR transition.

- The UK’s Financial Conduct Authority in July 2019 said it expects some banks to leave the Libor panels soon after 2021. At that point Libor would either stop or FCA would have to judge wither it was reliably accurate. FCA has noted that with so few transactions already underlying Libor, any further bank departures would make Libor even less representative.

- The Federal Reserve Bank of New York on Monday began publishing 30-, 90-, and 180-day SOFR averages as well as a SOFR index, in order to support a successful transition away from Libor.

- ISDA’s protocol for converting legacy derivative contracts is expected in Q3.

- GSEs like Fannie Mae will stop using Libor for ARMs and begin using SOFR in Q4.

- The creation of a SOFR term reference rate will take place in 2021. Mr. Bowman said the original plan called for that to happen at the end of the year but the hope is to move that up to H1 2021.