Companies on the cusp of IG may want to push for an upgrade and sacrifice some flexibility amid higher interest rates.

The surge in interest rates to 15-year highs has treasury teams at companies with credit ratings on the brink of investment grade (IG) grappling with an important decision: Should they push to achieve IG status or maintain the financing flexibility of being just below IG—an easier choice when Fed Funds rates were near 0% vs. 5% today.

- One treasurer attending a recent meeting of NeuGroup for Life Science Treasurers said she is planning to lobby the ratings agencies to upgrade the company to IG for the first time, in large part to help lower financing costs when the acquisitive corporate next needs to tap the debt markets.

- “We don’t have any maturities for a while, but the cost of debt is different and access to the debt market for high yield is changing too,” she said.

- Jacques Ouazana, head of US ratings advisory at meeting sponsor Societe Generale, said current circumstances make arguing for an upgrade a sound strategy. “With high-yield becoming more expensive, there’s more of an incentive to get higher [credit ratings]. The environment is different now.”

The quest for investment grade. The treasurer, who is new to the role, shared that her company has straddled the line between IG and high yield for over a decade and had worked with Moody’s and S&P to remain below the threshold. This helped the company maintain flexibility to finance acquisitions without worrying about a credit downgrade—a real concern for corporates rated IG.

- The treasurer will have to make an argument for an upgrade not only with the rating agencies but with the company’s audit committee, which has historically been in favor of staying high yield.

- Another member told her, “In a period of high volatility, there is a good case for wanting to be IG, especially if you will need capital in the next couple of years. It adds another tool to the toolkit.”

- Mr. Ouazana said different rate cycles call for new approaches. “Shifting the narrative toward more conservative financial goals can be exactly fine,” he noted. “You can point to those tangible differences and adapt.”

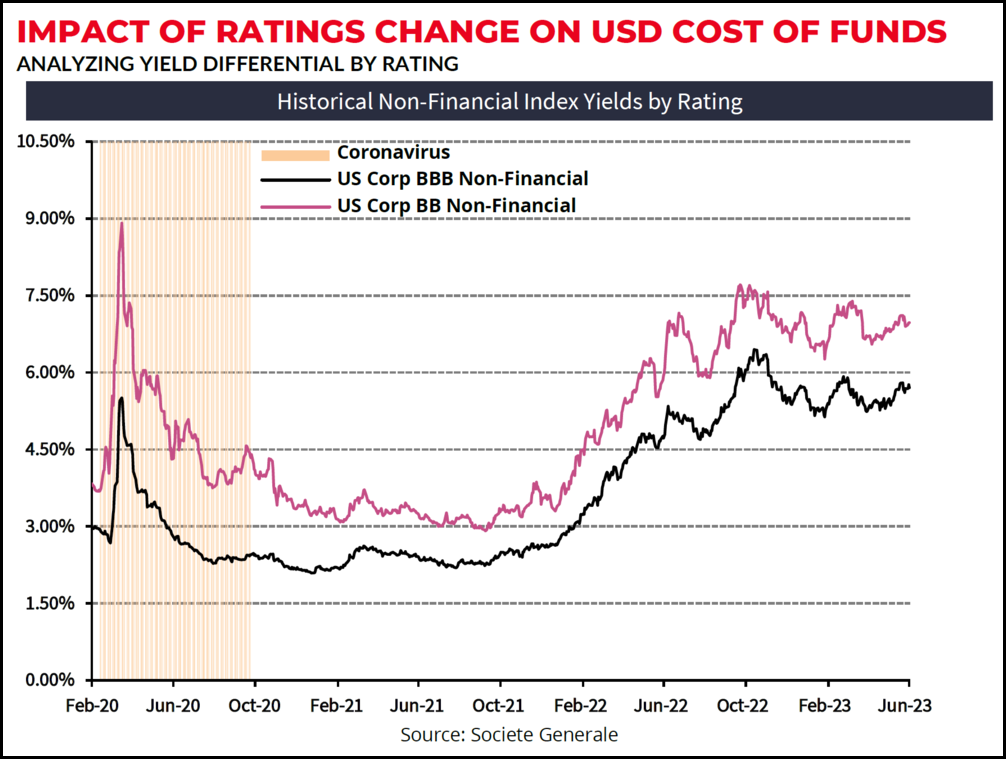

Mind the gap. Societe Generale director of debt capital markets Rob Grammer, who also attended the session, shared analysis of the relationship between ratings and cost of funds in a follow-up exchange with NeuGroup Insights (see chart below).

- Mr. Grammer explained that when there is an inverted yield curve in the US as there is now, there is a greater difference in yield than spread between bonds issued by upper-end high-yield corporates versus low-end IG, due to the duration mismatch of the indices.

- The IG benefit becomes more pronounced when yields are high and the yield differential is high, as they are currently. “When the BB index was trading at 3-4%, it didn’t really matter if the differential between BBB and BB was 200 basis points. The situation now is that yields are elevated and the differential has increased,” he said. “We also expect HY to underperform IG over the next year, so that gap should continue to grow.”

Proceed with caution, consider options. Though yields may favor IG corporates in the near future, the flexibility provided by a high-yield rating remains a significant consideration—especially for companies in the life sciences industry, which often engage in M&A deals financed with debt, raising the risk of a downgrade.

- Some leveraged finance bankers at another recent NeuGroup meeting provided a counterpoint to the argument for credit upgrades, suggesting that companies can still explore innovative debt financing options to make deals with IG rates while remaining in the high-yield space.

- As noted by NeuGroup founder Joseph Neu after that meeting, “There has been so much debt market innovation with private credit sources and private issuance options options, growth companies can postpone their public straight debt IPO and IG rating journey. Those who wish to retain flexibility by being unrated or rely on convertible or leveraged finance markets can therefore do so and not seek an IG out of the gate.”

The waiting game. Another member shared a strategy he executed in a previous role, holding off on negotiating an upgrade with the ratings agencies until the company could move up multiple steps up to be mid-tier investment grade, as he feared the repercussions of a downgrade back to a high-yield rating.

- “If you issue bonds at IG and then fall to high yield, they’re going to trigger an automatic sell, bond investors are going to be really unhappy with you and future capital market raises will be more visible even if you move back to IG,” he said.

- “After downgrades, I’ve seen some clients struggle to return to investment grade,” Mr. Ouazana said. “It’s mostly been about stability and staying where you want to be. But now we are in an environment where interest costs and free cash flow have tightened. The last 10 years have been about taking on more risk and potentially sacrificing ratings, but I think it is the beginning of a new era.”