Data from Clearwater underscores the concerns of treasury investment managers reducing risk during the pandemic.

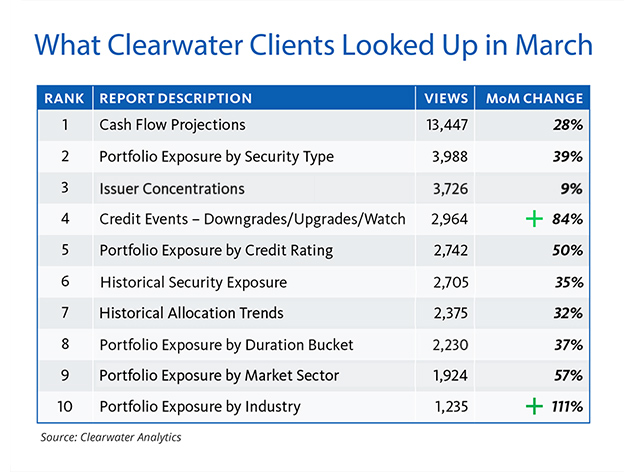

If you needed any more proof that the pandemic has made treasury investment managers even more attuned to the risks in their portfolios, check out the table below from Clearwater Analytics, which sponsored a NeuGroup meeting this week on market trends and improving balance sheet management.

Cash flow and credit. It may not be surprising, but relative to other searches, the sheer number of views in March of data on cash flow projections for securities and portfolios—more than 13,000—captures exactly what was the top concern of nearly every portfolio manager.

- Also noteworthy is the 84% jump from the prior month in credit events inquiries. The investment manager for a large technology company who described his experience and thinking in the last several months said that keeping track of the volume of downgrades and other credit actions was “breathtaking.”

- The same manager told his peers about having eliminated stakes in “industries we didn’t like” and reducing investments in energy, retail and health care credits. He said his team spent “an ungodly amount of time on credit.”

- And while not every treasury team does its own credit analysis, a widespread focus by managers on vulnerable sectors underlies the more than doubling (111%) in Clearwater views during March of portfolio exposure by industry.

Governance and communication. The importance of strong governance emerged as a key takeaway from the meeting. It’s critical, as several NeuGroup members noted, that a company’s management team not only understands the risks taken by the investment team but are also comfortable with them before a significant market disruption like that experienced this year.

- One member asked others if they were receiving any pressure from management to boost investment returns now that interest rates are closer to zero. And while managers whose companies issued debt at wide spreads in March said senior management is interested in reducing interest expense, that is not translating into pressure to take on greater risk with the cash.

Look around the corners. That said, investment managers who survived the first quarter and are now looking toward closing the books on the second are asking plenty of questions about how to position themselves for what lies ahead—much of which is uncertain. Many said they are still asking, as one of them put it, “What is the right amount of credit risk, liquidity, market risk, etc.”

- Whatever they do with cash in the months ahead, members are well advised to heed the warning of one peer who is constantly asking “what if we’re wrong?” in assessing what’s next. He noted that many observers doubted COVID-19 would move beyond Asia. That points up the critical need, he said, to keep doing stress tests. Without them, he said, “It’s hard to react if you’re on the wrong side of it.”