Inflation and uncertainty about interest rates leave many corporates waiting to add more floating-rate exposure.

Discussions and polling about fixed- to floating-rate debt ratios among corporate issuers at a recent meeting of NeuGroup for Capital Markets sponsored by Deutsche Bank made clear two key points:

- The overwhelming majority of companies are overly exposed to fixed-rate debt relative to what they consider ideal and what historical data suggests will reduce interest rate expense over the long-term.

- Volatile financial markets and uncertainty about inflation and interest rates have kept many of those companies from entering into interest-rate swaps to increase their exposure to floating rates. A few, though, are taking steps to reduce their exposure to fixed rates.

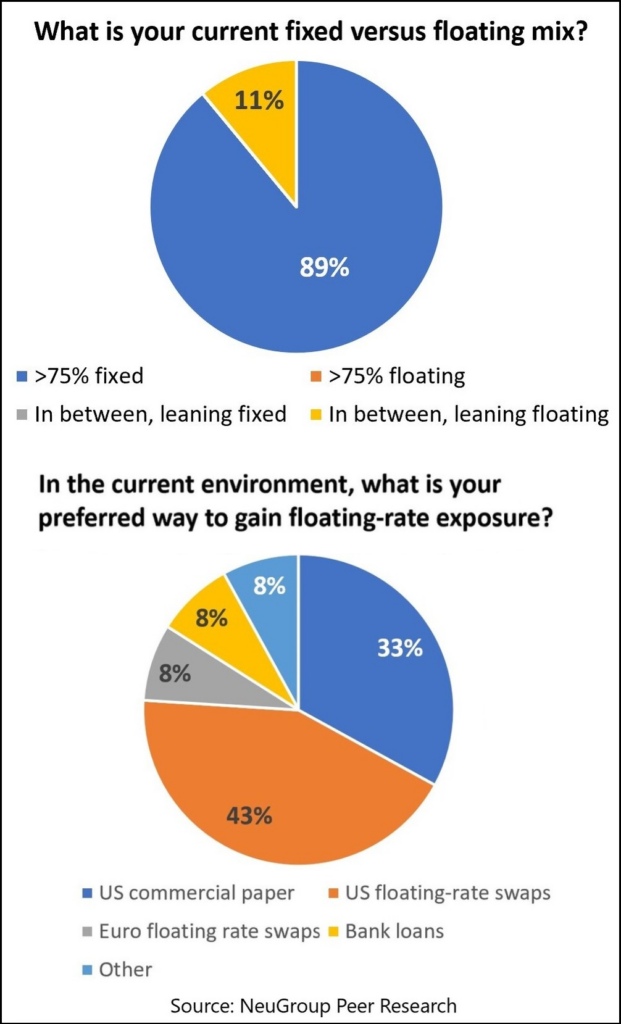

Fixed-rate debt dominates. A striking 89% of the companies polled at the meeting said that more than 75% of their debt is fixed rate. Several members said 100% of their debt is fixed. USD floating-rate swaps are how 42% of the corporates prefer to get exposure to floating rates, while 33% would rather issue commercial paper (see graphics).

- The heavy weighting to fixed rates reflects both an extended period of historically low interest rates that encouraged corporates to lock in rates as well as a surge in fixed-rate issuance as they increased liquidity at the beginning of the Covid pandemic.

- The reluctance of many companies to swap to floating reflects a belief that rates will continue to rise and that by waiting they will receive a higher swap rate on the fixed-rate leg of the swap, said Scott Flieger, who leads the NeuGroup capital markets peer group. “Companies have already benefited from waiting as rates have risen, following the age-old advice to ‘let the trend be your friend,’” he said.

- “The argument for doing something now is that maybe, just maybe, interest rates are near their high point and you don’t want to miss the market. Or maybe you just want to be prudent and do some hedging now and average your way into it,” he added.

Obstacles to swapping to floating rates. One member’s company has traditionally taken a programmatic approach to interest rate hedging but paused its program earlier this year as the Fed began hiking rates. Prolonged inflation and rate hikes have complicated the decision about when to restart gaining exposure to floating, he said.

- Typically, an economy facing recession, like the US appears to be, would provide a lower-rate environment where floating-rate debt is cheaper than fixed-rate debt and thus help lower interest expense during a business slowdown, the member said. However, today’s sticky inflation has thrown off that logic and forced the Fed to raise rates and increase the cost of floating-rate debt in the midst of a potential business slowdown.

- Another member, whose company began issuing fixed-rate debt at the beginning of the pandemic, is starting a programmatic interest rate hedging program. But launching it will in effect be a form of market timing, difficult in the current environment. “How do we get started?” he asked.

Challenges with timing the market. This member said pitching to senior leadership a negative carry (i.e., adding interest cost) on a swap-to-float trade in the current market is a “difficult conversation” given that corporate earnings face headwinds from supply chains, inflation, FX and other factors—“even if the long-term view remains the swap will have a positive outcome over the life of the trade.” He added:

- “While rates are rising, there is upside from collecting higher yields on invested cash.

- “Volatility is high with big, daily swings: a few months ago, some banks were telling us clients were waiting to swap when the 10-year Treasury hit 3%. Now we are at 4%! There is an aversion to putting on a trade only to find a large negative [mark to market] a few months later.

- “Of course, the peak of the Fed cycle is the ideal time to transact and at some point you’ll have to trust the thesis behind having floating-rate exposure and begin averaging into a position.”

Easing back in, Europe first. Here’s how one company is slowly getting back in the floating-rate exposure game after unwinding all of its swaps and being 100% in fixed, according to the member attending the NeuGroup meeting:

- The board approved a strategy to target floating-rate exposure between 20% and 30% going forward, which is lower than the historical approach of 40% or more.

- Treasury first plans to layer in euro-denominated floating-rate swaps to align with the company’s debt in euros, about 30% of its total debt. The relatively lower risk of prolonged rising rates in in the eurozone relative to the US and a positive initial interest expense benefit underlies this timing.

- The company will begin layering in US dollar swaps over four to five quarters as the Fed rate hiking cycle winds down, perhaps beginning in Q1 2023.