NeuGroup’s 2024 Agenda Survey shows most treasury teams plan to stay the same size as headwinds die down.

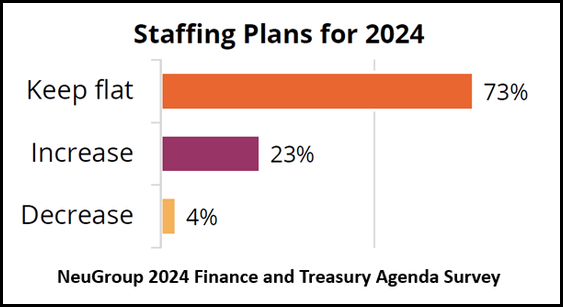

Rising interest rates and rampant recession fears early last year had some treasurers feeling pressure to cut costs and reduce treasury headcount. But as those headwinds eased, NeuGroup’s 2024 Treasury and Finance Agenda Survey conducted in late 2023 shows most treasuries planned to stay the course and keep team size flat or even expand staffing in 2024 (see chart below).

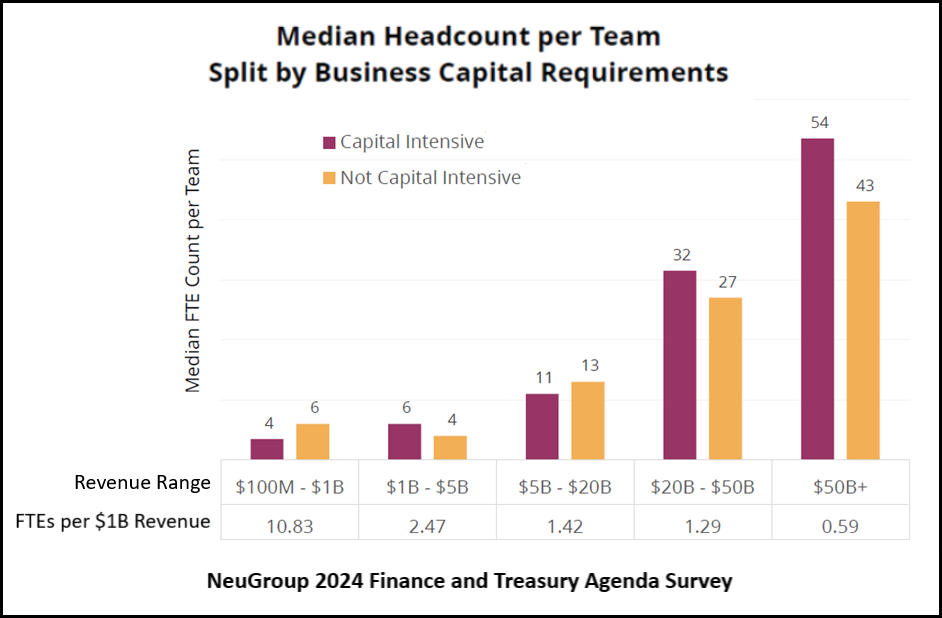

- A majority of respondents to the survey have treasury teams numbering between six and 24 full-time employees. The survey also documents that headcount can vary widely, naturally correlating to a company’s annual revenue—and that big, capital-intensive corporates typically have the largest treasury teams.

Reducing headcount organically. One reason treasury teams may decide against laying off employees this year is a strategy shared by a number of members in 2023 to not replace people who leave the company.

- “Our organization is going to evolve over time,” one member said. “That’s generally going to happen through attrition and planning to not backfill jobs that are realigning.”

- The member added that, through embracing centers of excellence to execute manual activities, “we’re going to be reducing headcount slowly over time. Three years from now, our treasury org structure will look different, but it won’t happen immediately.”

- Another member shared last year that his company’s corporate finance team planned to cut headcount in all departments but made an exception for treasury—which is actually expanding.

- In a session of NeuGroup for Mega-Cap Treasurers, a member who has been with his company for 12 years said the treasury team has generally remained the same size—but is now made up of more skilled and senior employees. “On average, we’ve leveled up by two positions,” he said.

Higher revenue, larger teams. As you would expect, the biggest corporations answering the survey typically had much larger teams than smaller companies (see chart below). As one member said at a 2023 meeting of NeuGroup for Life Science Treasurers, “taking on multiple roles is just par for the course at smaller companies.” That said, so-called double- and triple-hatting is also increasingly common at mega-cap corporates.

- “Something we’re thinking about is how do you increase efficiency with a smaller headcount,” another member said. A related challenge is not lowering standards in the quest for efficiency. “We’re always striving for quality and timely execution too,” the member added.

Bigger and more efficient teams. Although treasury team sizes tend to grow with annual revenue, the largest companies by revenue benefit from economies of scale. Those with more than $50 billion in revenue have less than one FTE per billion in revenue (0.59), one measure of efficiency.

- The results above are split into capital-intensive companies and non-capital intensive companies, with capital-intensive defined as corporates operating in industries where more than 50% of earnings before interest and taxes are allocated to net capital expenditures.

- NeuGroup’s Scott Flieger clarified that, “It is challenging to produce ratios that make sense to everyone, because the results can get skewed by companies that have very high revenues but small EBITDA because their margins are low.”

- Capital-intensive companies benefit less from economies of scale—but still are far more efficient as measured by the FTE-revenue ratio than smaller corporates with lower revenues.