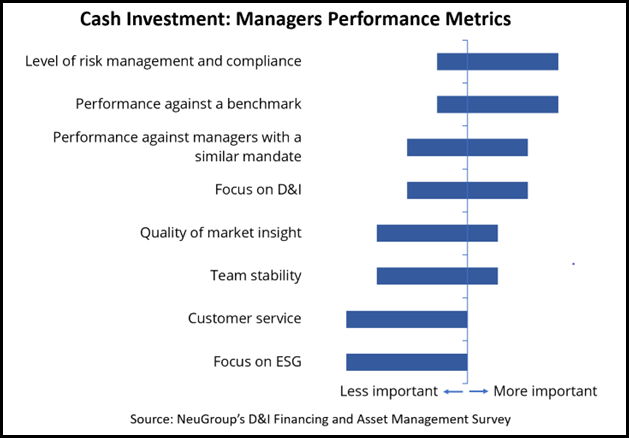

A NeuGroup survey shows treasury prioritizes risk management and performance against a benchmark when evaluating diverse-owned firms.

Eighty-six percent of respondents to NeuGroup’s D&I Financing and Asset Management Survey do not have a formal D&I policy, but 54% work within informal guidelines. Regardless of approach, the overall investment policy requires that treasury apply performance metrics when it selects external managers for investment of cash and evaluates their success over time.

- The survey reveals treasury applies the same performance measures to diverse-owned investment managers as it does to their peers.

- “We hold them to the same metrics, all the way from performance to timely reporting and quarterly market updates,” said one cash investment manager.

The chart above shows the relative importance of metrics treasury uses to assess return on cash invested by minority-owned managers. It reveals treasury is consistent in its approach. Given the conservative nature of cash investments, risk management and compliance with guidelines, and performance against the benchmark, are tied for the number-one spot, followed by performance against managers with a similar mandate.