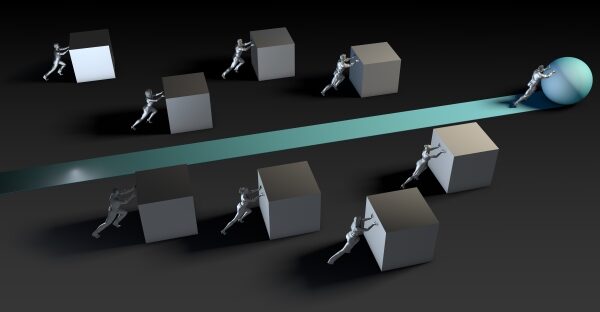

Regular monitoring and analysis of metrics can help identify areas of strength and weakness, and ensure efficiency. Treasury performance metrics are crucial for corporations as they provide a framework for assessing the efficiency and effectiveness of their treasury operations. They serve as a window into how well the treasury team is functioning in a variety of areas, from cash management to payments to foreign exchange. At a recent meeting of NeuGroup for Mid-Cap Treasurers, one member gave an updated presentation on…