Treasurers predict a sixfold surge in the adoption of AI-enabled analytics tools.

Cash forecasts are notoriously unreliable, primarily because of limited visibility into current and forward-looking data. However, in a year when liquidity is going to come at a premium, treasury must develop a clearer understanding of where cash is today, and how much more is coming down the pipeline. Cognizant of this need, treasurers responding to NeuGroup’s 2023 Finance & Treasury Agenda Survey ranked improving analytics and modeling capabilities as one of their top five priorities for this year.

- NeuGroup’s 2022 Cash Forecasting Survey found that one-month cash forecast accuracy was +/- 10% in 75% of the cases.

- That is a very wide range when it comes to assessing a company’s ability to pay the bills and invest in growth.

- Rising economic pressures and financial market volatility require that forecasts not only be more accurate but, in many cases, also more frequent.

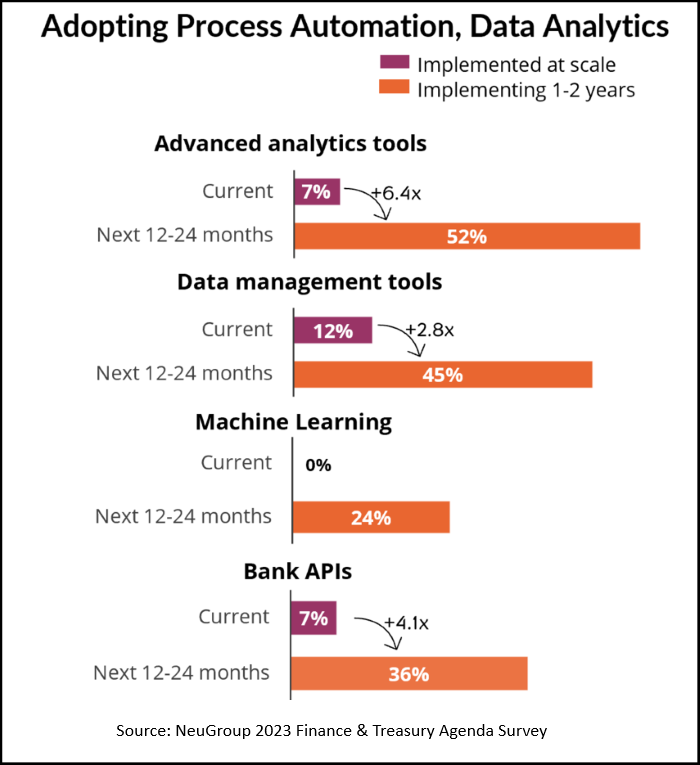

Smart automation. Yet collecting and analyzing data about current and future cash remains a largely manual process at many companies; this perennial pain point accounts for the more than sixfold forecasted increase in the adoption of advanced analytics tools over the next 12-24 months (see chart below).

- AI-enabled analytics can improve forecast accuracy and increase forecasting cadence by automating data curation and applying sophisticated algorithms.

- High-quality, consistent data is essential to the effectiveness of advanced analytics; NeuGroup’s findings reveal a projected 2.8x jump in the use of data management tools over the next two years.

- Treasurers are beginning to move to next-generation smart automation: 24% of them expected to implement machine learning tools in the 12-24 months, compared to zero right now.

The benefit of bundling. The pivot to new tools reflects that many TMS vendors have struggled to provide effective forecasting solutions. While TMS adoption is still expected to grow by 43% over the next two years, all-inclusive systems are being supplemented and supplanted by emerging technologies.

- Vendors that are incorporating AI and ML into their products are likely to see healthier growth rates and higher market share.

- In one recent case, a member of NeuGroup for European Treasury said he selected a TMS that has incorporated AI into its core engine versus one with less sophisticated analytics capabilities.

Connectivity everywhere. The survey also shows a meaningful increase in the deployment of connectivity technologies, like robots and APIs. Both connect disparate internal and external source systems by automating the flow of data among them, and centralizing the storage of that data. Going forward, a combination of connectivity and data and analytics tools can potentially upend the need for an all-in-one system.

- Bank APIs got off to a slow start, in large part because banks chose to develop proprietary protocols, making the technology less scalable. But API adoption is set to jump 4.1x over the next 12-24 months, as the technology matures and new, API aggregators and other middleware come on the scene.

- RPA adoption is set to rise by 1.4x in the next two years.

A case to make. Granted, this may be a tough year for getting technology budgets, and some large-scale projects may be placed on hold. However, projects with a shorter and clearer ROI will continue to draw investment, and treasury has a strong business case for to make:

- Many of its routine activities can and should be automated to reduce cost.

- By employing tools like AI, treasury can make significant progress toward more efficient liquidity management and contribute greater value to senior management.