Data from The Hackett Group show more companies plan to launch talent development initiatives this year.

The good news is that more finance teams are placing a higher priority on aligning the skills and talents of their members with changing business needs amid digital transformation. The somewhat bad news is that many of those teams currently lack the abilities necessary to make that alignment a reality.

- Those are among the takeaways from survey data collected and analyzed by The Hackett Group and presented at several NeuGroup 2020 second-half meetings by Nilly Essaides, senior research director for Hackett’s finance advisory practice.

Progress report. Finance teams looking ahead ranked aligning skills and talent with changing business needs among their top 10 priorities in Hackett’s 2021 Key Issues Study. That’s a sign of progress, Ms. Essaides said, given that talent development did not crack the top 10 a year earlier.

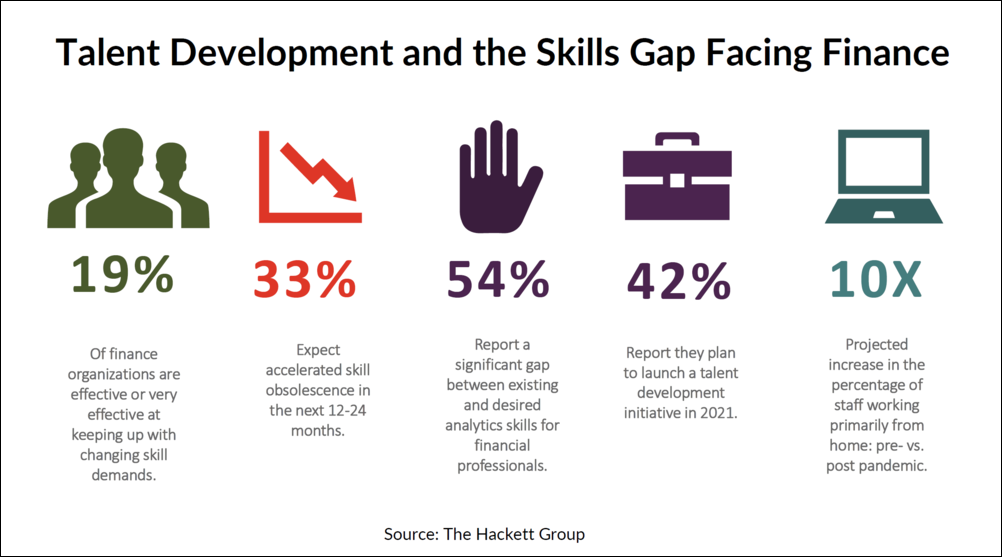

- That fact provides context in which to evaluate the significance of 42% of finance organizations reporting they plan to launch a talent development initiative in 2021—one of several findings presented in the graphic below.

- “I see more and more finance teams that want to own staff development rather than hanging on the coattails of HR,” Ms. Essaides said. “There’s more interest by CFOs to develop these programs.”

Pushed by the pandemic. The prioritization of skills development is also significant as it comes amid the pandemic and plans by many finance teams to cut costs and enable remote work through process automation—the number one initiative on the function’s transformation agenda for this year.

- “Covid has really intensified the need to go digital,” Ms. Essaides said, adding that Hackett is seeing increased use of robotic process automation (RPA) and cloud-based applications, among other signs.

- More than 20% of the organizations surveyed plan to hire more RPA specialists, data architects and scientists, and digital transformation managers.

Falling short. The graphic also shows that more than half of those surveyed (54%) see a big gap between current and desired analytic skills. More broadly, Hackett data show that finance organizations ranked their staffs’ lack or deficiency of critical skills second among the hurdles to making “transformation progress,” Ms. Essaides noted.

- Those critical skills include analytics, emerging technologies, process redesign, design thinking and change management.

- Technology and process complexity ranked first on the list of hurdles and organizational resistance to change came in third.

It’s not all about analytics. It’s critical to remember that in addition to technical and analytical skills, finance team members must possess the “ability to tell a story,” as one NeuGroup member put it.

- Other NeuGroup members and Ms. Essaides agreed on the need for so-called soft skills that form the basis of communication, the ability to negotiate and influence and bring groups together.

- Hackett calls these “core skills,” in part to counteract the perception that soft is somehow less important than the hard skills that often overshadow qualities that are essential for leaders in finance and every other function.