Editor’s note: NeuGroup’s online communities provide members a forum to pose questions and give answers. Talking Shop shares valuable insights from these exchanges, anonymously. Send us your responses: [email protected].

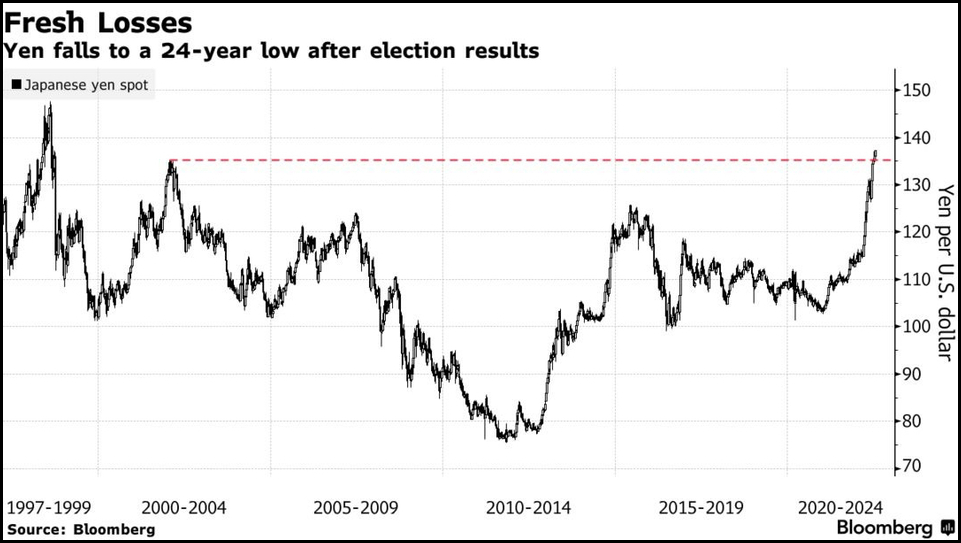

Member question: “Here are some benchmarking questions about cash flow hedging:

1. “What percentage of cash flow exposures do you hedge?

2. “What instruments do you use to hedge?

3. “How far into the future do you hedge?

4. “Given the current strength of the US dollar, are you contemplating changing your FX hedging program?”

Editor’s note: NeuGroup’s online communities provide members a forum to pose questions and give answers. Talking Shop shares valuable insights from these exchanges, anonymously. Send us your responses: [email protected].

Member question: “Here are some benchmarking questions about cash flow hedging:

1. “What percentage of cash flow exposures do you hedge?

2. “What instruments do you use to hedge?

3. “How far into the future do you hedge?

4. “Given the current strength of the US dollar, are you contemplating changing your FX hedging program?”

Peer answers, question 1 (hedge ratio):

a. “We follow a layered and rolling approach that goes from 80% in the nearest quarter to 70% two quarters out, down to 10% eight quarters out.”

b. “Most currencies are 70%-80% hedged. There is one high-cost currency that we hedge 50%-60%.

c. “For us it can go as high as 95%.”

d. “We hedge up to 85% for the nearest quarter and as low as 25% for four quarters out.”

e. “We hedge about two-thirds of foreign earnings, primarily through seven key currencies.”

f. “Our goal is a rolling, layered approach, getting up to a hedge ratio of 80%-100%.”

Peer answers, question 2 (instruments):

a. “We use a combination of forwards and option collars. This allows us to have the flexibility to choose the instrument that will best protect us. We also have a small budget for option collar premium cost, so we can play around with strike rates based on where we want the protection and/or participation to be.”

b. “Primarily forwards, with some zero-cost collars fairly soon.”

c. “We use FX forwards only, but are in discussions on incorporating options to the program.”

d. “We use forwards and put options mostly. Options are used on the longer tenors.”

e. “We’re aiming for a base case of forwards, with the ability to use purchased options or zero-cost collars based on a framework around spot relative to long-term fair value, as well as skew, carry and vol.”

Peer answers, question 3 (time frame):

a. “Three years.”

b. “We layer out, with our longest hedge about 15 months.”

c. “Tenors are out 18 months, with most of the program in place for the year before we issue guidance.”

d. “Two years maximum.”

Peer answers, question 4 (program changes):

a. “Given USD strength, we are considering making some changes. We are looking at hedging foreign expenses out at least six quarters, instead of the normal four, and at an initial higher hedge ratio coverage. And we are considering increasing our premium cost to create a more favorable strike rate band on our billings and revenue hedges.”

b. “We hedge expenses, so the current market is quite favorable, relatively speaking.”

c. “Our current hedging program is not adjusted based on market dynamics, but that’s something we are considering changing.”

d. “We have been following our existing layering schedule but continue to analyze whether to make any changes.”

e. “Under our proposal, the instrument we select could possibly change based on the level of USD, but not the overall strategy.”

f. “No fundamental changes are being contemplated at the moment.”