Former NeuGroup members look to convince today’s treasurers that the current system needs to change.

By Joseph Neu

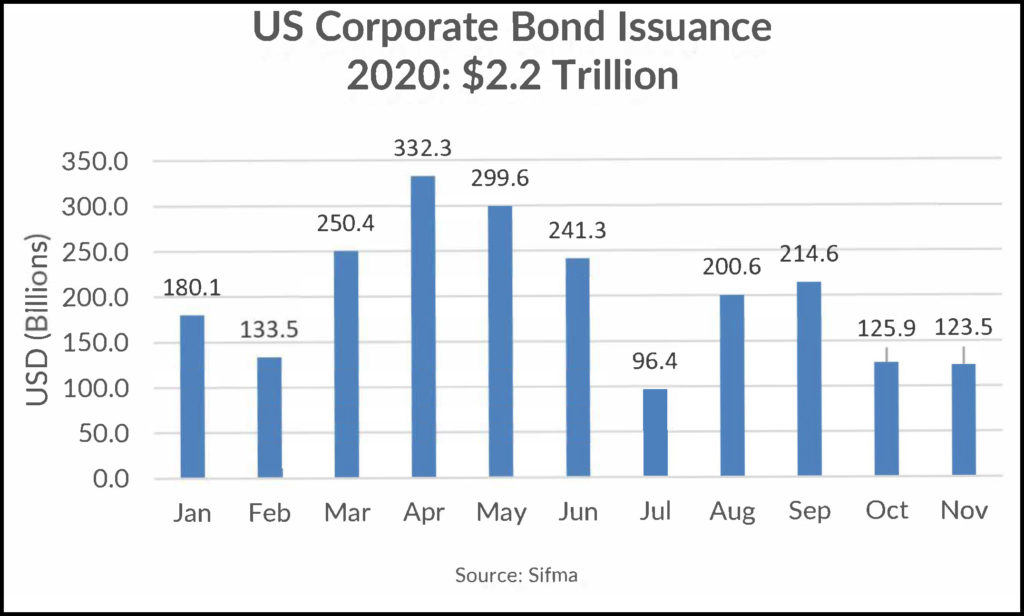

In the wake of a record year for corporate debt issuance—around $2 trillion in the US alone, generating estimated fees for banks topping $8 billion—this is a good time to assess if the corporate bond market needs transformation.

- As part of a new series of virtual interactive sessions on fintech solutions to perennial treasury and finance function challenges, NeuGroup hosted a session last week looking at a corporate bond issuance auction platform backed by several NeuGroup member alumni and created for corporate issuers.

- This fintech’s solution stands apart from others in that it is created by treasurers for treasury.

Former NeuGroup members look to convince today’s treasurers that the current system needs to change.

By Joseph Neu

In the wake of a record year for corporate debt issuance—around $2 trillion in the US alone, generating estimated fees for banks topping $8 billion—this is a good time to assess if the corporate bond market needs transformation.

- As part of a new series of virtual interactive sessions on fintech solutions to perennial treasury and finance function challenges, NeuGroup hosted a session last week looking at a corporate bond issuance auction platform backed by several NeuGroup member alumni and created for corporate issuers.

- This fintech’s solution stands apart from others in that it is created by treasurers for treasury.

- Members who attended the session and saw the platform demo expressed real enthusiasm for the transparency, control and efficiency it offers. After all, who wouldn’t want to pay less for more?

A striking lack of innovation. As one member noted during the opening session assessing lessons learned from the work from home (WFH) bond issuance experience, “There’s a striking lack of innovation—it feels like we are in the stone age.”

- It starts with reporting and compliance workflow: “Our bond deal was almost derailed in March because the printer couldn’t print and file all the documents,” the treasurer noted.

- There is little pre-sale data other than how an issuer’s bonds are trading in the secondary market, and that does not necessary reflect actual investor preferences with a new issue.

- The sales process gets executed by banks, mostly by phone and chat, without sharing of information on the bids and allocations as they happen.

- Bond deal pricing is not optimized for best price execution, and the bank’s fees are mostly fixed, which leaves little incentive to innovate.

The conclusion: During the pandemic, some workflow for deals had to change to adapt to WFH, including virtual roadshows. But fundamentally, bonds got sold the way they always have been.

Oversubscribed. Unless you were an issuer in distress due to Covid, your bond deal was oversubscribed this year (by a lot). This suggests pricing is not reflecting demand. According to research cited by the fintech, US corporate bond offerings have increasingly been oversubscribed since the 2008 global financial crisis and remain underpriced by an average of 32 basis points.

- If bonds are priced to move, then how much work are the underwriters doing to earn their fees from issuers?

- If demand exceeds supply, then why not allow for an efficient auction with reverse inquiry even before an issuer starts to test the waters?

Direct the allocation. So much is being sold directly in our increasingly digital world that the buy-side is growing more comfortable with the direct issuance of corporate bonds. That said, big bond investors with good relationships with the top dealer banks may be ok with the current system.

- But issuers want to diversify their bondholders in favor of the buy-and-hold cohorts (no hedge funds, please), and bond investors who must practically beg to get bonds are also supporting electronic platforms.

- This includes corporates themselves, who often must scramble to buy bonds for their pension and cash investment portfolios.

- Some issuers help their peers by instructing underwriters to allocate a percentage of their deal to other corporates.

- Growing interest in diversity and inclusion (D&I) has also shown up in allocating bonds to Black- and minority-owned institutions to sell and purchase. This is yet another driver of issuers wanting to have more control.

- There are also green and other ESG-related bonds that issuers may want to see land with investors with specific ESG mandates they favor.

Roadblocks. Despite the need for change, there is some skepticism that the current economics of corporate bond issuance will allow real transformation to take hold.

- The fees paid for bond issuance are a means for corporate treasurers to compensate banks for a wide range of other services, starting with credit facilities and loans, that do not reflect a true market cost of credit.

- But should bond economics be allowed to continue if banks are still able to charge for underwriting and market making that they are restricted by regulation from performing in the same way they used to?

- Corporates that have banks as significant customers must also factor in how much of their commercial relationship is factored into the bond economics.

- Treasurers may only receive minor credit from bosses if they shave fees from a bond transaction; but they could lose their job if a major bond deal falters.

- True or not, the impression persists that a banker might press an institutional investor to buy bonds to prevent a deal from failing.

- “Saving some on fees is not worth the risk of a deal going south on you,” one treasurer said.

- On the other hand, some treasurers get the impression that junior bankers are mostly those working the phones these day—and they may not have as much sway with investors. (We guess they can hand the phone to an MD if needed.)

- Perhaps an algorithm can be made smart enough with the right data at its disposal to prevent a deal from faltering without calling upon personal relationships.

Status quo appeal. Another obstacle: Less experienced corporate debt capital market teams at infrequent issuers may want to stick with a status quo where banks guide them through the process.

- “How does a platform offer the same kind of hand-holding as we get know from our banks?” one session participant asked.

- Would the treasurers backing a platform arrange for handholding, including training and development without a pro-bank tilt, for inexperienced bond issuers?

- Also, there are treasurers who work hard at wallet management and analysis and believe that they come out well under current bond economics. They say they pay less overall compared to market pricing for credit and other services.

- Even if they are not convinced they are leaving money on the table with the fees banks are setting, they may still have reason to overpay for bond issuance.

First movers. With all this said, what is required for a digital transformation of the corporate bond market is for some issuer of stature to be a first mover. And most corporate finance types are reluctant to be a first mover. Still, the enthusiasm of those who see transformation as inevitable, spurred on by all the acceleration of change brought about by Covid, might just do it.