Credit rating agencies sit down to weigh in on hot topics with Tech20 treasurers at the annual breakfast panel.

Each year, members of NeuGroup for Tech Treasurers sit down with tech sector analysts from S&P, Fitch and Moody’s to discuss their pressing questions for the credit rating agencies. This year’s conversation revolved around the hot topics of inflation and ESG. One important takeaway: there’s not much for tech companies to worry about (yet).

- The chief lending officer at meeting sponsor BNY Mellon moderated the discussion with Andrew Chang, director of corporate ratings at S&P; Jason Pompeii, senior director of corporates at Fitch Ratings; and Rick Lane, senior vice president at Moody’s.

- A selection of questions and answers follow, and have been edited for clarity and brevity.

Credit rating agencies sit down to weigh in on hot topics with Tech20 treasurers at the annual breakfast panel.

Each year, members of NeuGroup for Tech Treasurers sit down with tech sector analysts from S&P, Fitch and Moody’s to discuss their pressing questions for the credit rating agencies. This year’s conversation revolved around the hot topics of inflation and ESG. One important takeaway: there’s not much for tech companies to worry about (yet).

- The chief lending officer at meeting sponsor BNY Mellon moderated the discussion with Andrew Chang, director of corporate ratings at S&P; Jason Pompeii, senior director of corporates at Fitch Ratings; and Rick Lane, senior vice president at Moody’s.

- A selection of questions and answers follow, and have been edited for clarity and brevity.

Question: Inflation is rising at its fastest pace in decades, fueled in part by surging demand, increased consumer spending and supply chain disruptions. What are your inflation expectations for 2022 and how might rising prices affect tech companies’ credit ratings?

Mr. Lane (Moody’s): “My sense is that inflation is not going to be as strong as what some people suspect. Especially with this group here, there’s a deflationary element to what everyone in the tech sector does; they’re not as exposed to some of the cost pressures as other sectors.

- “Intellectual property and software are less exposed to inflationary pressures, and though supply chain is an issue for some folks here, it could be a 1% to 2% impact in the short-term. It’s a cost that can be well-accommodated in the business model and the credit rating.”

Mr. Chang (S&P): “I’m sort in the same camp as economists that view it as transitory, though that word has certainly been overused this year. But we view it as transitory with the caveat, at least from S&P, that it’s been stronger and longer than we had anticipated, but still transitory.

- “Customer prices will be permanently higher as a result, and if that’s not offset by higher wages then purchasing power will be falling, which would slow demand and bring inflation back to target. While it looks out of control for now, our economists still view it as transitory.

- “From a tech perspective, the inflation concern is a limiting factor. Companies have costs that are rising and supply constraints, but have been able to pass along the price increases to consumers, and their customers have been willing to accept higher prices because they are in need of the tech supplies, so we don’t see that impacting our view of the credit.”

Mr. Pompeii (Fitch): “I think there’s already been an indication of the slowdown in bond repurchases, there’s an expectation that rates will rise in 2022. It’s important to remember that, obviously, there’s a lag effect there.

- “We do expect there to be inflation in the meantime; though our institutional view remains that it’s largely transitory, we still expect it to be extending well into 2022. I think this all makes sense in the context of the supply and demand picture, and all of the government intervention taking place that is unprecedented in our lifetimes.

- “Expect things to start normalizing in 2023. We have very low interest rates, obviously, but it’s difficult to get too concerned about [inflation] at this point.”

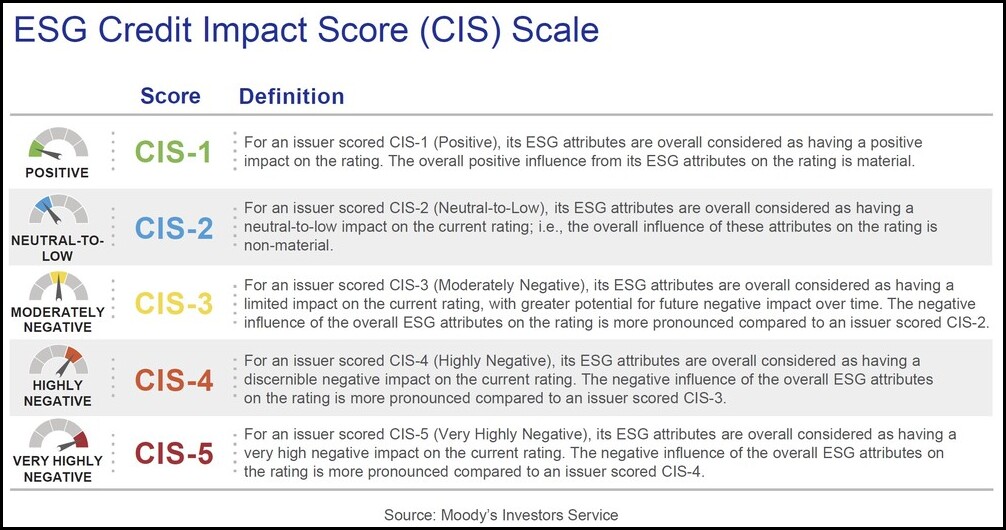

Question: What steps are the credit agencies taking to provide transparency and visibility into the role ESG factors have on ratings?

Mr. Chang (S&P): “With our ESG credit indicator, we’re trying to call out ESG factors that are already being integrated in the ratings. They’re mostly neutral for tech, unlike oil and gas for example.

- “This is largely investor-driven, as fixed-income investors want to know or want a picture of ESG factors on their credit ratings. One differentiating factor from third-party ESG raters is we have a line of communication with every issuer, we actually get to talk to the treasurer and get a more granular view of ESG, which benefits fixed-income investors.

- “One question asked consistently in our calls with issuers is that some were disappointed that they, as a large hardware/software provider, are proactive in tackling these ESG factors and they should be rated higher on a score from one to five.

- “Our response is that the ESG factor has to be significant enough to impact the overall credit to be a one, for example. A two is our neutral score, which the majority of tech issuers get. It’s a pretty high bar to get to a one.”

Mr. Pompeii (Fitch): “At Fitch, what we’ve done is focused more on the importance of the discussion of ESG. These are factors we’ve always looked at, so it’s really just a reflection on how significant that discussion is.

- “Not unexpectedly, it really comes down to, for the most part, governance and the shareholder concentration and private equity ownership. Those sorts of things are most common instances where we would say this is more important.”

Mr. Lane (Moody’s): “We’ve begun to roll out ESG scores for a number of companies, we’ve just done some preliminary drafting for the tech sector amongst others. We’ve got 21 ratings in our ratings system, but for ESG we’ve got five ratings. A one is extremely rare, and a five is also pretty rare, so there are really only a few ratings we can have.

- “We’ve always incorporated ESG into our ratings, we simply had not called those out, so we’re becoming granular and transparent about this and their credit rating impact. Our efforts now on the ESG front are going to be a bit more transparent and break out the environmental, social and governance issues.

- “We’re not taking the approach of sustainability aspects, we’re speaking of ESG factors as they relate to credit ratings. Over time, we may become more quantitative and use third-party data, but that’s not where we’re starting off.”

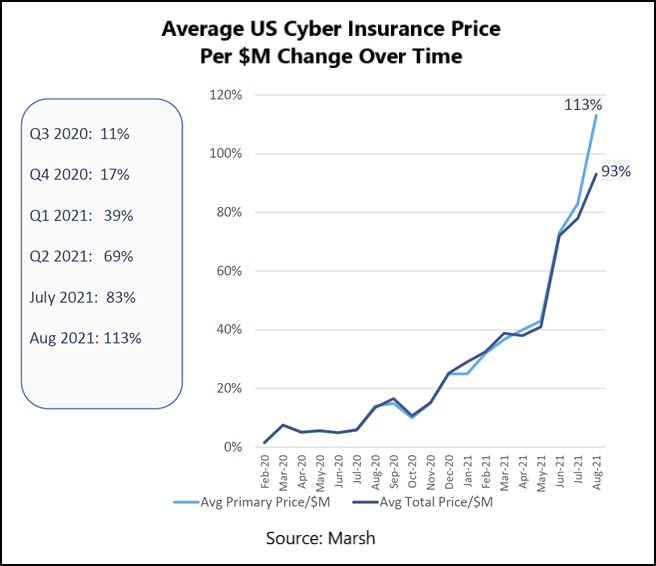

Question: Are there any updates on cybersecurity and how that can impact credit ratings? [Earlier this year, Moody’s sent a cybersecurity survey to some issuers.]

Mr. Chang (S&P): “The cybersecurity issue is embedded in the G side of our ESG program. To the extent that the company makes a serious error, those things will be reflected on the governance side and potentially on the credit rating, but I don’t believe we’ve taken memorable ratings actions yet.”

Mr. Pompeii (Fitch): “At this particular point, our response to that has been pretty reactive. I can think of a couple of cases in which we perhaps would put out a comment or maybe provide an outlook based on an event that maybe wasn’t strictly due to cybersecurity issues.

- “It will be interesting to see how we’re going to be able to assess, objectively, the steps that are being taken from a cybersecurity standpoint. I think over the medium-term, what we’re doing will be to the extent that disclosure does not meaningfully change our ratings.”

Mr. Lane (Moody’s): “We’ve put out a lot of research on cybersecurity, we’ve got a growing group that’s focused on that more elevated risk aspect, especially from an operational/reputational standpoint.

- “A fair bit of our work is reactive, commenting on particular instances. Over the next few years, we’re going to try to sharpen our pencils and be a bit more proactive, but at this point it’s more observatory.”