What happens to your AI-based model when historical data and cash flow patterns are disrupted?

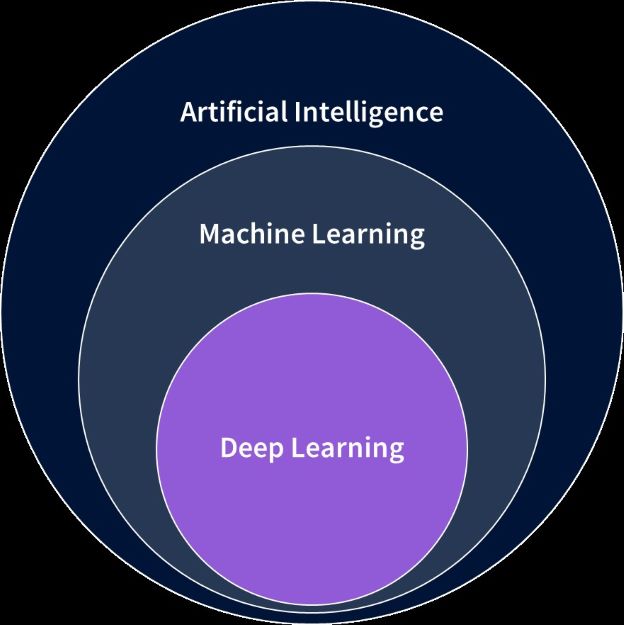

Cutting-edge cash forecasting models that make use of artificial intelligence (AI) and machine learning will, inevitably, require manual adjustments by humans to account for seismic disruptions like the pandemic. The good news is that AI models will eventually catch up with the new normal, becoming more accurate with less intervention.

- That was among the insights offered by Tracey Ferguson Knight, director of solution engineering (treasury) for HighRadius, who participated in a recent NeuGroup Virtual Interactive Session, “Cash Forecasting During a Crisis.”

- “That’s the key to machine learning, it’s going to adapt,” Ms. Ferguson Knight said in a follow-up interview. “The better the models are, the faster they will catch up.”

What happens to your AI-based model when historical data and cash flow patterns are disrupted?

Cutting-edge cash forecasting models that make use of artificial intelligence (AI) and machine learning will, inevitably, require manual adjustments by humans to account for seismic disruptions like the pandemic. The good news is that AI models will eventually catch up with the new normal, becoming more accurate with less intervention.

- That was among the insights offered by Tracey Ferguson Knight, director of solution engineering (treasury) for HighRadius, who participated in a recent NeuGroup Virtual Interactive Session, “Cash Forecasting During a Crisis.”

- “That’s the key to machine learning, it’s going to adapt,” Ms. Ferguson Knight said in a follow-up interview. “The better the models are, the faster they will catch up.”

Miles to go. Unfortunately, most NeuGroup members still rely on Excel and the knowledge of a limited number of treasury analysts, who don’t typically have data science skills.

- If those analysts leave, treasury may be unable to make an immediate change to a forecast that they didn’t build and don’t always understand, Ms. Ferguson Knight said.

- To address this, several members said they want to improve data sourcing, build better data models, standardize and share data science skills and tools across treasury and FP&A, establish a center of excellence and explore professional service firms as a backstop.

Pandemic pace. The uncertainty created by COVID-19 has magnified the importance of cash forecasting—especially for companies that are not cash rich—a theme heard often during exchanges among NeuGroup members in the last five months. And many companies are now forecasting more frequently.

- More than one member said their company is now doing daily cash forecasts that go out 12 months, which one member called excessive. “I can’t count how many different scenarios we’ve done,” he said.

- “Forecasting cadence has increased dramatically,” Ms. Ferguson Knight said. “Companies that use to forecast quarterly, they might be doing it monthly now. Those that were doing it monthly are doing it weekly. Those that were doing it weekly are sometimes doing it multiple times a day.”

- Companies that rely on manual processes will have difficulty increasing the speed and accuracy of forecasts, she added. “With AI and data science and a vendor that’s providing better models, you’re able to increase accuracy.”

AI playbook. The odds of success at using AI to improve the accuracy of cash forecasts rise if you:

- Start with a baseline. This is where a master cash-flow model is helpful. And if you have used algorithms to produce cash forecasts with accuracy pre-crisis, you can use these as a baseline.

- Compare forecast to actuals. Use AI tools and treasury team members to review comparisons of forecasts to actuals.

- Consider manual changes. People may be aware of change or see things in the data that might prompt immediate manual changes in the forecast and the forecast model.

- Allow the AI tool to learn. From there, keep feeding the data into the AI-tool so that it can learn from the changing data patterns and errors between the forecast and actual result.

AR and AP. HighRadius’ AI focuses heavily on accounts receivable (AR) and then accounts payable (AP). It will require:

- A master list of data (customer or supplier variables).

- Correlated data from related variables shown to influence predicted payment data by the customer with AR, for example.

- Appling multiple algorithms to predict that payment date/receipt of the cash from AR for the cash or when your AP will pay for cash outflow.

Algorithmic accuracy. Your cash forecasting system should then switch to algorithms that show the most success in predicting the cash inflow and outflow. We learned in an earlier session on AI used in cash forecasting that certain algorithm types do better with unexpected changes in data patterns. How quickly the algorithms learn pattern changes to bring cash forecasts back up to the 90+ percentage accuracy levels will depend on:

- The frequency and tenor of the forecasts. If you are doing monthly forecasts for the next month it will take longer than if you are doing a daily forecast for every day out a month.

- The granularity of your forecast. For example, if you pull data to forecast cash from each legal entity and bank account, the AI may learn faster than if you forecast by pooling entity or some other aggregate.

- Corporates should aim for the most granular level of detail they can get and the frequency they can achieve reliably and aggregate from there. The more cash poor you are, the more there will be an incentive to forecast with more detail and frequency.