Founder’s Edition by Joseph Neu Insights on the reasons to tap revolvers and what the trend may mean for banks and treasury. One clear insight emerging during our first several NeuGroup virtual meetings as the COVID-19 crisis escalates is that corporates are taking a slew of steps to bolster their liquidity positions. Among the most notable: All but the most stellar credits are drawing on revolving credit facilities (RCFs), a move that has potentially profound implications for banks.

- As Reuters noted recently, “After the 2008 financial crisis, several blue-chip companies drew down on revolving credit facilities, shocking banks that had charged minimal interest margins on the assumption the loans would remain unused (my emphasis).”

Founder’s Edition by Joseph Neu

Insights on the reasons to tap revolvers and what the trend may mean for banks and treasury.

One clear insight emerging during our first several NeuGroup virtual meetings as the COVID-19 crisis escalates is that corporates are taking a slew of steps to bolster their liquidity positions. Among the most notable: All but the most stellar credits are drawing on revolving credit facilities (RCFs), a move that has potentially profound implications for banks.

- As Reuters noted recently, “After the 2008 financial crisis, several blue-chip companies drew down on revolving credit facilities, shocking banks that had charged minimal interest margins on the assumption the loans would remain unused (my emphasis).”

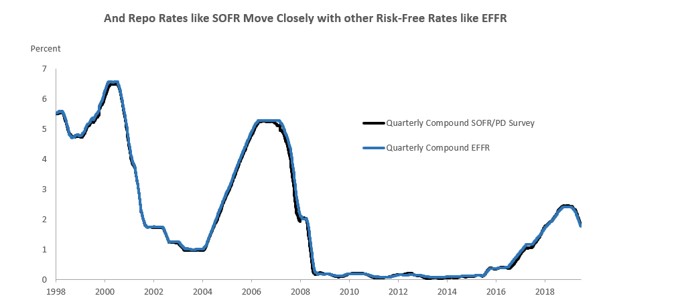

This time is different—kind of. The good news is that 12 years after the financial crisis began, banks are solid, have buffers and are in a good position to weather this storm; plus, central banks are backing them in a bigger way. Yet the pricing of RCFs, in the US especially, still largely assumes they will remain undrawn and often does not reflect the true cost of the credit.

- If the stigma of drawing on an RCF for a company that normally relies on the capital markets goes away, then bank pricing of them will need to reflect that.

- Indeed, it is happening already as banks have been adjusting the pricing of liquidity on RCFs, bilats, term loans et al. If you were used to 35 to 45 basis points over on an RCF, you should not expect any new lending at that price—it has gone up, said one banker to our members. If everyone one draws, and rating agencies start to rethink downgrading, banks are going to start to feel more pain and reprice their risk further. For some, their liquidity and capital ratios may come under duress. Banks will remember who drew when it comes time to renew.

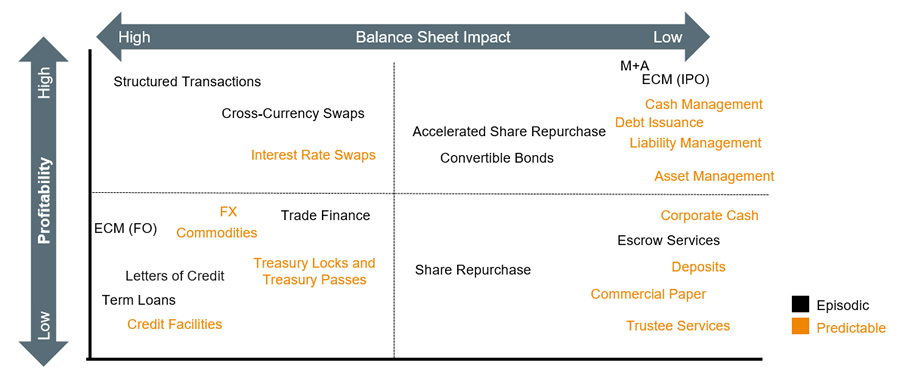

- So, if the drawing on RCFs continues, accordingly, treasurers should be prepared to kiss the RCF market they are used to goodbye. This will obviously have knock-on effects on the entire business model for bank pricing, fees and wallet analysis and bank relationship management.

Here are more of my takeaways on this topic from what we’re hearing from members and bankers so far:

Hoarding toilet paper. A banker invited to the opening of a Zoom meeting last week characterized the liquidity and capital markets situation as being like hoarding toilet paper: Those wealthy enough to buy and store it in bulk are creating shortages. They don’t need as much as they are buying, preventing those who really need toilet paper from finding any.

- Similarly, high-grade corporates are taking as much liquidity as they can, hoarding cash and crowding out other market participants. Some are drawing on RCFs and term loans when they don’t have liquidity needs. Those with big needs are drawing down big facilities.

- It feels like the stigma of this move signaling duress is gone.

No pushback. One member walked thought the thinking to draw a significant portion of his facility. “We spoke to the banks and our rating agencies and got no pushback.” One bank said “this is unusual, as we have not seen other companies in your sector do it,” but that was it. Rating agencies did not seem concerned “as our plan was to sit on the cash.”

CP market becoming hard work. A big reason to consider a draw is that the CP market is getting more difficult. One A2/P2 member has still been able to place paper even at one-month tenors (due to the quality of its name and business position in this crisis), but it’s been choppy. A1/P1 issuers are have only a bit better luck, but some quality names are reporting it’s taking more of an effort to place CP.

MAC clause concerns. A significant consideration in drawing before you need to is the MAC clause. If you think COVID-19 might trigger a material adverse change in the business, then it’s a reason to draw sooner.

Deposit cash in banks you draw on. To mitigate some of the renewal repricing from drawing on your RCF, banks will advise you to deposit the drawn funds back with them. Unfortunately, the risk evaluation is not often the same for the banks you allow to provide you credit and those you will extend credit to in the form of a deposit. You also need to see if there is a set-off clause in the revolver.

Bank deposits or T-Bills? Part of the decision to draw on a facility is the bank risk, so one member said his plan is to put the cash into T-bills vs. bank deposits. Money market funds are also being watched closely. Prime funds (post reform) are facing their first crisis test, with some floating NAVs below $1, testing gates etc.

No to 8-K. While law firms have advised some members on the need to file an 8-K with a draw, other members got comfort that they could avoid the headline risk by foregoing an 8-K. They will have to note the draw in the 10-Q, but they have some time until the end of the quarter to determine if they want to pay it back before or not.