Promoting people in finance who want strategic roles can be challenging if they find some CFO duties unappealing.

By Joseph Neu

During the first peer group meetings of NeuGroup’s spring season, I have been listening intently for signals indicating how finance functions are changing course. One trend may be the strengthening of strategic finance roles under the CFO. This development arises in part because not everyone who is drawn to strategic, value-enhancing roles wants responsibility for everything in a CFO’s job description—transactional controls and compliance, for example.

Promoting people in finance who want strategic roles can be challenging if they find some CFO duties unappealing.

By Joseph Neu

During the first peer group meetings of NeuGroup’s spring season, I have been listening intently for signals indicating how finance functions are changing course. One trend may be the strengthening of strategic finance roles under the CFO. This development arises in part because not everyone who is drawn to strategic, value-enhancing roles wants responsibility for everything in a CFO’s job description—transactional controls and compliance, for example.

- Of course, a growing emphasis on value creation has boosted the allure of the C-Suite for some members. They include FP&A leaders who, like treasurers, enjoy the more strategic path their roles have taken. At one recent meeting, we encouraged FP&A leaders to think about skills and mindsets needed to step up to the CFO role.

- One session examined the evolution of the CFO’s position, moving from a transactional focus favoring executives with heavy controllership experience to one well suited to value creators with insight and analytical superpowers, favoring those who’ve come up through the FP&A ranks.

Is there another way to advance? But given that not everyone wants the full spectrum of CFO responsibilities, what else could heads of FP&A do next in their careers? As they search for answers, CFOs seeking help on value creation may benefit from considering a career path that elevates team members who excel in this area and want to focus on it.

- One potential solution is to continue to elevate their titles from VP to SVP to EVP and even create a C-suite role of chief planning and analysis officer or chief strategy officer.

- A similar career path should be considered for those in treasury who want to be less transactionally and operationally focused. The same executive-level solution could apply. Indeed, CFOs have asked us for titles of treasurers so they can benchmark how many are VPs vs. SVPs or EVPs.

- Also, could another C-suite role be designed, akin to a chief risk officer or chief of capital?

Reviewing rotations. One recent treasury meeting highlighted a change in one member’s rotational program to encourage assistant treasurers to become business CFOs, and business CFOs to become ATs. This pushes down the strategic finance rotations increasingly seen at the treasurer level. (The path of AT to business CFO was pioneered years ago by the treasurer’s office at General Motors.)

- The mutual advantage is pushing treasury value creation drivers into the business so business leaders learn to value them; and it brings business finance leaders into treasury to learn and use value-added skills when they return to CFO jobs.

- Eventually, these business-level CFOs with treasury experience and ATs with business CFO experience will need to learn to love both being transactional focused and value creators, or they too will experience challenges to advance.

Regional centers. The other area where treasury-CFO role combinations can make sense is in regional centers, especially co-located with a regional headquarters, or in countries where regulations or other restrictions prevent them from being effectively managed centrally.

- Regional treasurers in Europe or APAC (or North America for non-US MNCs) can be given CFO responsibilities and serve as deputy regional CFOs.

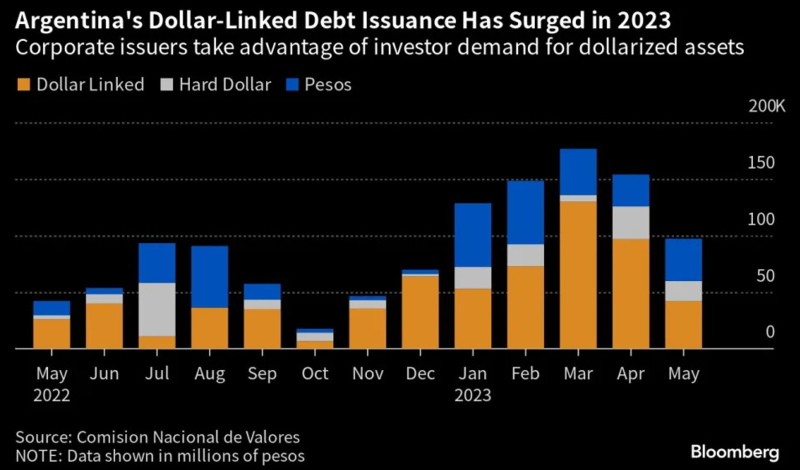

- Local treasurers in regulated or restricted currency countries like Argentina may also have broader finance director/country CFO responsibilities to help justify the extra local finance head count.

- Arguably, this does an even better job of pushing treasury value creation drivers into the business since regional centers or in-country entities are often closer to the periphery business initiatives than corporate. It also exposes treasury professionals to CFO skill sets, including FP&A and, of course, transactional reporting, controls and compliance responsibilities.

- Treasurers who lead tax are also prone to give these regional or local team members tax responsibilities in addition (or instead).

Decentralized org models. Pushing value creation out to the business front lines is behind the thinking of some companies to undo the centralization of SG&A, including finance. Pushing decisions out to the periphery makes firms more agile, the thinking goes, making it worth sacrificing the efficiencies and controls of centralization.

- Companies that decentralize in this way must also undo some specialization and deploy new CFO types who also can be effective at treasury and FP&A, while also being transactional reporting and compliance specialists.

The impact of AI. One constraining factor on rotational programs through specialty finance areas like treasury or tax is that so much specialized knowledge is needed to be highly effective. A treasurer or tax director who has a very knowledgeable team or even a single senior direct report can get away with not having deep knowledge for a rotational assignment lasting several years. Rotating too many team members at once could disrupt this.

- Specialty knowledge, however, could be documented and learned by AI assistants, who could in turn support strategic finance types as they rotate along. This could allow more team members to rotate or may reduce the need for future finance leaders to spend as much time in as many finance roles.

- AI might also excel at being a strategic generalist, as much or more than being a specialist; so specialists may be needed as a control on AI decision-making, with fewer CFO-types needed.

- AI could impact CFO career paths as well by handling the transactional pieces that people who like strategic, value-enhancing paths prefer to do without. Hence, the controller bias in the path to CFO could evolve away since AI (with some human specialist control points) may handle all of that for CFOs in the near future.

It is probably too early to say how this will all play out.