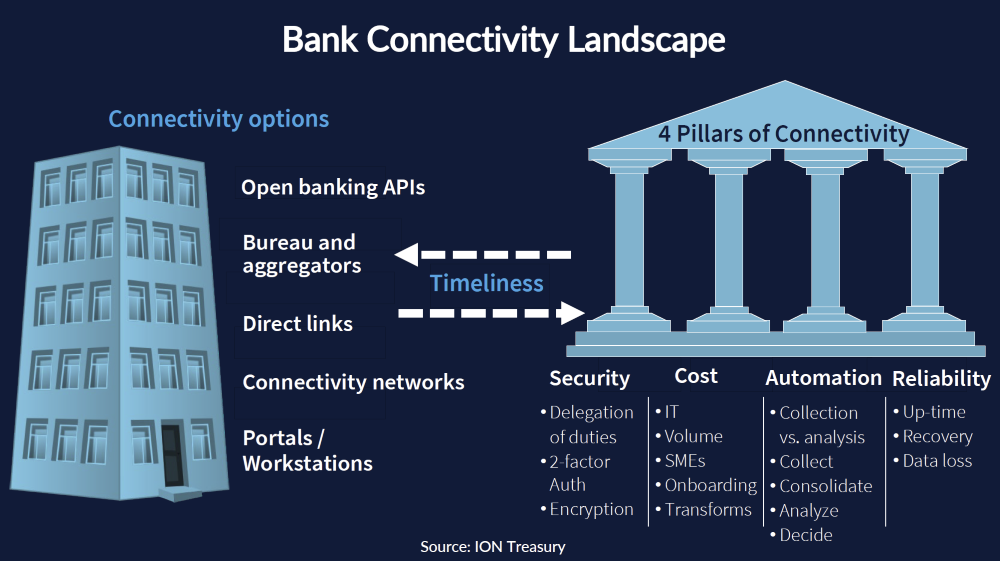

Perspective on where APIs are adding value from a global bank that’s ahead of the curve.

A banker at a top US global bank invited to a recent session of NeuGroup for Global Cash and Banking said real-time balance (intraday) reporting is the bank’s most popular API, followed by payment transaction tracking. Regarding “as a service” offerings:

- Real-time reporting will be part of the bank’s larger vision for reporting as a service to provide real-time balances and FX rates.

- That will be complemented by FX as a service to provide trade booking alongside rates and mass pay initiation globally with separated FX trades at market rates.

Perspective on where APIs are adding value from a global bank that’s ahead of the curve.

A banker at a top US global bank invited to a recent session of NeuGroup for Global Cash and Banking said real-time balance (intraday) reporting is the bank’s most popular API, followed by payment transaction tracking. Regarding “as a service” offerings:

- Real-time reporting will be part of the bank’s larger vision for reporting as a service to provide real-time balances and FX rates.

- That will be complemented by FX as a service to provide trade booking alongside rates and mass pay initiation globally with separated FX trades at market rates.

- Global payments will fit into its payments-as-a-service offering, which starts with real-time payments and confirmations, automated status updates and payment tracking, along with beneficiary validation and payments investigations.

- Payments will carry over to accounts receivable (AR) with receivables as a service to help with invoice management and automated reconciliation.

- Administration and onboarding as a service will provide account and administrative visibility for authorized signers and deactivation when they leave the organization.

- Account management then extends to liquidity as a service to integrate virtual account management, account structure reporting and more via open APIs.

End-to-end operations. From a corporate finance function perspective, the promise of APIs may also be seen in the ability to connect more finance operations end-to-end.

- By integrating internal systems and external as-a-service offerings, CFOs can bring more processes under one view, if not one leader, across treasury, AR and AP, and more often with SSCs or other centers of excellence in the mix, too.

Streamlining and real-time workflow automation. More workflow and process streamlining across finance operations will also magnify the extent to which people and other resources can shift from administrative transaction processing to value-added work involving analysis and solution support for the businesses.

- As a NeuGroup member presenting noted, “We currently have technology analysis and admin functions for all our different bank connectivity platforms.”

- Every one of those that can be eliminated frees up resources for other things.

Obstacles to progress. What is standing in the way of the future promise of APIs is their uptake across the global banks, whether on their own or as part of SWIFT gpi on the payments side. To some extent, this will depend, among other things, on:

- How successfully banks implement APIs to transform banking services, on their own and with fintech partners.

- How other parts of the ecosystem, including the treasury systems providers, service bureaus and aggregators, deploy APIs vs. other means of bank connectivity optimization.

- How quickly API-driven solutions free treasury and finance staff from transaction administration to focus on analysis and business support.

- How quickly corporate IT functions get comfortable with API access across their corporate firewall.

- How quickly data compliance teams looking across customers in various jurisdictions with different data governance models can sort out what data can be accessed via the APIs.

One step forward… None of these items will be cleared easily or immediately. Treasurers also should be prepared to take an occasional step back to eventually move forward.

- One member noted that his company had implemented direct API bank connectivity recently only to have its corporate IT security team pull the plug on it because it was deemed too high risk.